TL;DR

- The price of Bitcoin has suffered corrections since March, driven by large sell-offs from whales and a massive token unlock, increasing the supply of altcoins in the market.

- The selling pressure has countered the positive flows from stablecoins and BTC ETFs, although an optimistic outlook remains for the coming months.

- Whales, who hold more than 1,000 BTC, have notably influenced the market, and approximately $35 billion in tokens have been unlocked since March.

The price of Bitcoin has gone through some notable corrections since March. This has been influenced by a combination of significant sell-offs by whales and a massive token unlock that has increased the total supply of altcoins in the market.

A recent report from 10x Research notes that these factors have countered the positive flows from stablecoins and Bitcoin exchange-traded funds (ETFs), as well as the growing use of leverage in futures contracts. According to the report, while it is unfortunate that early token holders’ sales have kept prices stagnant since March, the future outlook remains optimistic.

Today's report explains the reasons behind the sell-off that began in March and why, despite strong inflows from stablecoins, Bitcoin ETFs, and a rise in futures leverage, Bitcoin hasn't rallied. The main factors are heavy selling by Whales and the large token unlocks, which have…

— 10x Research (@10x_Research) October 4, 2024

The Bitcoin Situation May Improve in 6 to 12 Months

Markus Thielen, founder of 10x Research, emphasized that a potential increase in economic growth in the United States, along with interest rate cuts by the Federal Reserve due to declining inflation and strong corporate profits, could have a positive impact on Bitcoin’s price in a six to twelve-month horizon. Despite the current corrections, it is suggested that the economic situation may improve, providing some relief to the cryptocurrency.

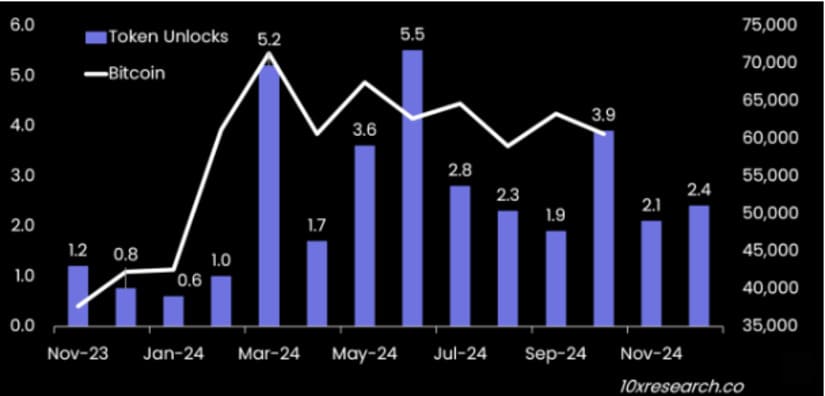

Whale sell-offs have been a critical factor in Bitcoin’s performance throughout the year. Those who hold more than 1,000 BTC have significantly influenced the market, especially between April and August. The activity of these large investors has indicated an intent to sell, which has contributed to BTC’s inability to gain upward momentum. At the same time, the unlocking of tokens has intensified selling pressure, with approximately $35 billion in tokens unlocked since March. In October, $3.9 billion in unlocks were recorded, a sharp increase from $1.9 billion in September.

Future Risks and Factors to Consider

Despite the selling pressure generated by large transactions and the increase in token supply, institutional flows, which include investments in ETFs, stablecoins, and futures markets, have helped stabilize the market. These flows, although neutralized by selling, have prevented more abrupt price declines.

On the other hand, the macroeconomic environment, marked by uncertainty about employment in the U.S., has influenced market volatility, indicating that as the economic reporting season approaches, institutional flows will play a key role in the dynamics of the crypto market