TL;DR:

- Jupiter DAO is debating whether to proceed with the 700M $JUP airdrop or adopt a zero net emissions model funded by treasury buybacks.

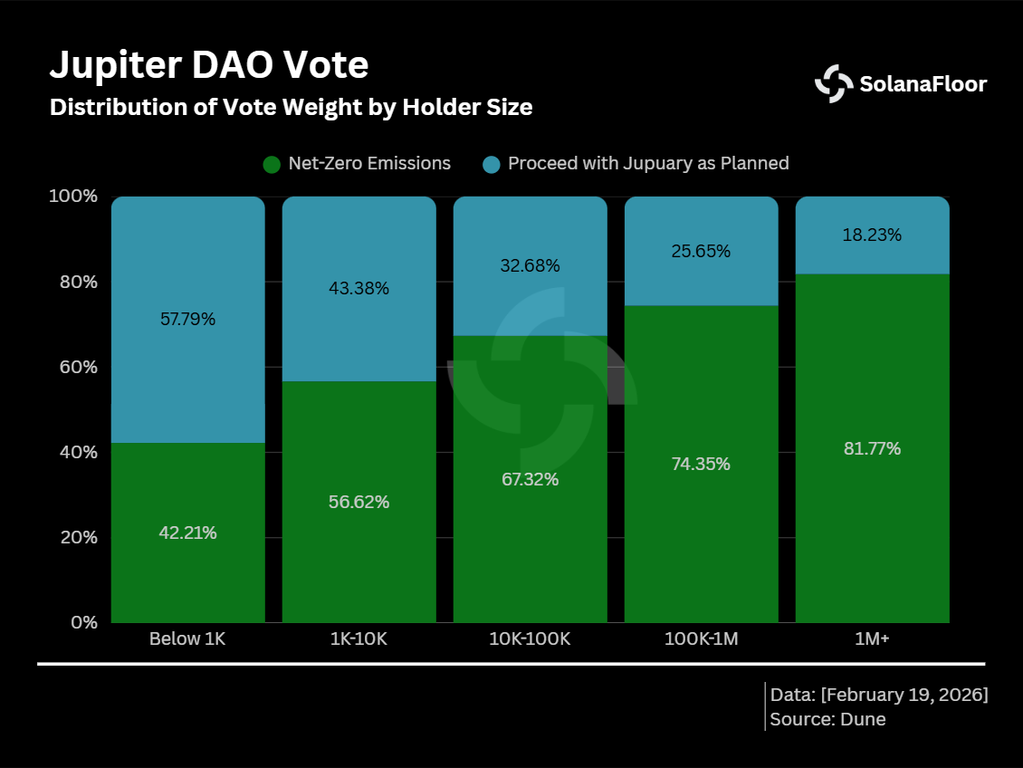

- Holders with more than 1M $JUP staked directed 81.7% of their combined voting weight to the zero emissions option, which is leading with 73.9% of the total.

- The ten largest wallets backing the zero emissions proposal hold more than 22.5% of the total voting weight, sparking debate over fairness in governance.

The Jupiter DAO finds itself at one of the most significant crossroads in its ecosystem’s history. Launched on February 17, the ongoing vote presents two opposing paths for managing the future supply of $JUP: executing the planned airdrop of 700 million tokens, known as Jupuary, or adopting a zero net emissions model that would halt new issuances and begin executing buybacks funded by the protocol’s treasury.

Within 48 hours of the process launching, more than 24,500 votes were recorded. By wallet count, the option to proceed with Jupuary leads with more than 13,000 individual voters. However, DAO governance is not determined by the number of wallets but by the weight of staked tokens behind each vote. Measured in those terms, the zero emissions proposal controls 73.9% of the total voting weight.

Whales Against the Tide: The Weight of Capital

An analysis of the onchain distribution reveals a clear fracture between large and small holders. Wallets with more than one million Jupiter (JUP) staked directed 81.7% of their combined weight to the zero emissions option. As stake size increases, support for halting emissions and implementing buybacks has become markedly pronounced. At the opposite end, wallets holding fewer than 1,000 $JUP are overrepresented among airdrop supporters.

Part of the debate has historical roots within the platform. Jupiter emerged from Mercurial Finance, a stablecoin protocol that received 5% of the total $JUP supply, equivalent to 350 million tokens, during the transition. As of the close of February 2026, approximately 182 million were already in vesting. Under the zero emissions model, those tokens would be offset through treasury buybacks to avoid additional selling pressure on the market.

Jupiter: Concentration of Power and Its Limits

The distribution of voting power has also generated tension within the community. The ten largest wallets backing zero emissions account for more than 22.5% of the total weight. One of them, holding more than 27.7 million $JUP staked, is the largest whale involved in the process. Meow, co-founder of Jupiter, confirmed that the address belongs to a project co-founder and that the votes originate from allocations with structured vesting.

The debate has been reopened over whether token-weighted governance systems allow concentrated capital to define outcomes independently of majority participation. The counterargument is that large holders assume greater financial exposure and have stronger incentives to preserve long-term value. The vote remains open, and its outcome will define not only the protocol’s emissions policy but also the credibility of its decentralized governance model.