TL;DR

- Vitalik Buterin frames Ethereum as a neutral base for building applications without censorship or intermediaries, detached from market trends.

- Ethereum aims to break the concentration of the internet by enabling applications that remain operational without central providers and without relying on the companies that support them.

- While the network advanced in scalability and zkEVMs, its price and ETFs did not follow the same trajectory.

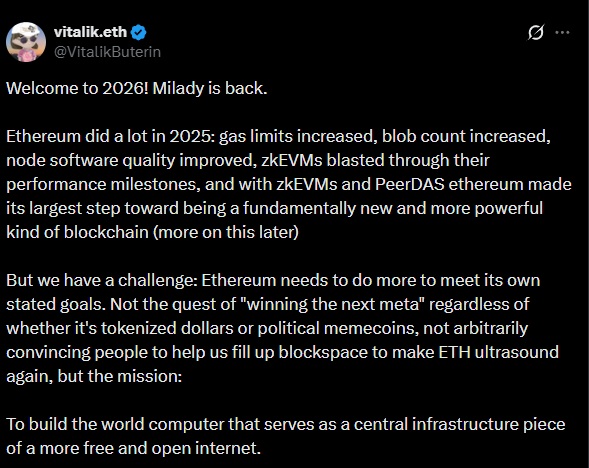

Vitalik Buterin defined Ethereum as a tool to break dependence on centralized infrastructure. The core focus is not its price, trendy narratives, or competing for the next market theme. The objective is to build applications that operate without censorship, without intermediaries, and without the need to trust third parties.

Buterin argues that the internet has reverted to an extreme concentration model. A small number of companies control data, services, and access. Most digital products operate as permanent subscriptions that lock users into a provider. Ethereum aims to function as a neutral base that allows applications to run even if the companies that created them or the services that currently support them disappear.

The network targets applications that do not rely on centralized infrastructure, that remain active even if a provider like Cloudflare goes down, and that do not require permission to operate. Its scope is not limited to finance; it extends to digital identity, governance, and any system that requires operational continuity and resistance to censorship.

Buterin: Ethereum Must Keep Improving

In 2025, Ethereum implemented several upgrades. Gas limits were increased, blob usage expanded, node software improved, and zkEVMs reached record performance levels. The integration of zkEVMs and PeerDAS moved the network closer to a more scalable and flexible architecture. For Buterin, these advances are not enough. The network still needs to improve its capacity for mass usage and its real level of decentralization, both at the base layer and at the application layer.

However, the market did not reflect the network’s technical progress. Ethereum trades roughly 40% below its all-time high of $4,950. ETH ETFs recorded heavy outflows: $1.4 billion in November and $616 million in December.

Even so, some institutional investors continue to see an optimistic outlook for 2026. Tom Lee expects a favorable scenario if the macro environment once again supports digital assets, following the same path as gold, which is trading at record highs.

A structural contradiction remains unresolved. Banks, fintechs, and stablecoin issuers use Ethereum as infrastructure while deploying centralized models on top of a network designed to achieve the opposite. Ethereum does not choose its users. It defines the rules of the system