TL;DR

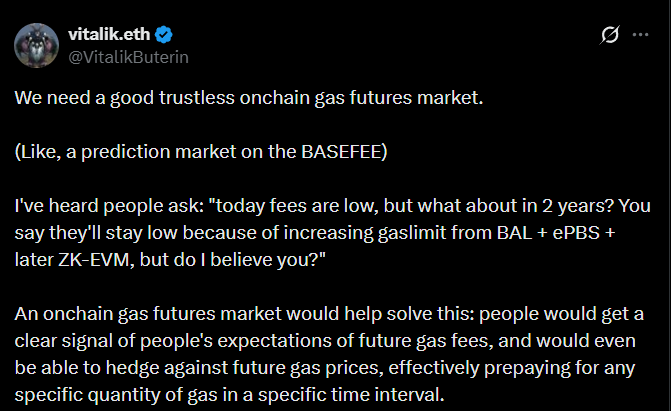

- Vitalik Buterin proposed an on-chain futures market that redefines how Ethereum handles gas and turns fees into a predictable cost.

- Vitalik introduced a model that lets users purchase a defined amount of gas at a fixed price, removing the uncertainty that affects exchanges, rollups, and services.

- This mechanism provides clear economic signals about future blockspace demand, organizing costs and helping teams plan their scaling decisions.

Vitalik Buterin outlined a proposal that would change how the Ethereum network manages gas fees by redesigning its economic model.

Buterin’s proposal introduces an on-chain futures market that allows users to buy a defined amount of gas at a fixed price for later use. The idea moves away from a system driven by congestion and unpredictable costs, bringing Ethereum closer to a model where users can plan their expenses and operate with a stable cost structure.

Exchanges Will Be Able to Lock In Their Future Usage

Today, fees rise and fall according to real-time demand. Developers and high-volume businesses have no reliable way to know how much they will pay when deploying contracts, processing transactions, or running scheduled tasks. The new system offers the ability to lock in prices ahead of time. An exchange, a rollup, or an automated service can secure part of its future gas usage and avoid unexpected spikes that could distort margins or disrupt critical processes.

These contracts would be traded directly on-chain, and their pricing would reflect expectations of future activity. If higher traffic is expected, futures become more expensive; if projected demand falls, the contracts get cheaper. That behavior makes it easy to read the expected pressure on blockspace and gives development teams a concrete basis for adjusting deployments and planning updates. Buterin’s model does not replace EIP-1559; it extends it. Gas stops being a reactive cost and becomes an input that can be secured in advance, similar to how a company fixes its energy or bandwidth rates for its operations.

Buterin Expands the Utility of EIP-1559

The operational benefits would be direct. Applications that process thousands of daily transactions can neutralize fee volatility and maintain steady service levels. Developers gain a predictable environment to organize their work without relying on low-congestion windows. Companies that use Ethereum for payments, verification, or data management obtain a clear cost structure, a necessary condition for scaling long-term projects.

Buterin’s proposal would also affect the network itself. A futures market generates clear economic signals about expected blockspace usage, helping inform scaling decisions, infrastructure investments, and capacity adjustments. The proposal does not promise lower fees; it aims to bring order to them, turning a volatile input into a resource that can be planned ahead