TL;DR

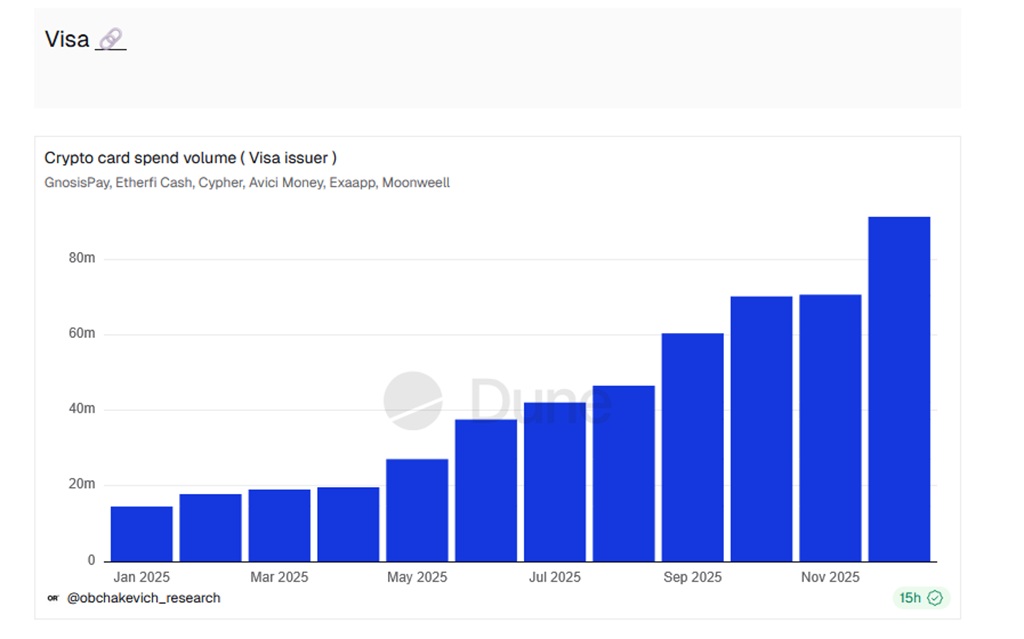

- Spending across six Visa-linked crypto cards rose 525% in 2025, climbing from $14.6 million in January to $91.3 million in December.

- Cards from GnosisPay, Cypher, EtherFi, Avici Money, Exa App, and Moonwell were analyzed in the Dune report.

- Visa supports stablecoins across four blockchains and has created an advisory team for banks, merchants, and fintechs.

Spending with Visa-issued crypto cards surged 525% in 2025. Data from Dune Analytics shows that the combined net spend across six cards increased from $14.6 million in January to $91.3 million by the end of December.

The cards analyzed belong to crypto projects operating in direct partnership with Visa. The list includes GnosisPay, Cypher, EtherFi, Avici Money, Exa App, and Moonwell. Among them, EtherFi stood out most clearly in the report. Its card recorded $55.4 million in net spending over the year, far ahead of Cypher, which ranked second with $20.5 million. The remaining cards trailed by a wide margin.

A Shift in Consumption and Payment Patterns

One takeaway from the report is that users are no longer keeping these cards as a backup option; they are using them on a daily basis. They pay for goods and services with them. Growth does not hinge on a one-off spike or a promotional campaign. It reflects adoption tied to stablecoins and deeper integration with traditional payment infrastructure.

The report also explains why Visa has been stepping up its push into the crypto market. The company already supports stablecoins across four blockchains and has been signing technical and commercial agreements to broaden access for both retail and institutional clients. The objective is to integrate cryptocurrencies into the existing payment system without creating operational friction.

Visa Provides Specialized Stablecoin Advisory Services

In December, Visa launched a stablecoin-focused advisory team aimed at helping banks, merchants, and fintechs launch and manage products built around these assets. Its primary goal is to capture payment flows before competing firms do.

The rise in card spending also reinforces the view that cryptocurrencies are no longer used solely as speculative assets. They are now operating as payment instruments. The volume is not coming from traders, but from users who spend and rely on them in everyday transactions.

If the trend continues to deepen, 2026 could become a pivotal year for stablecoins and for Visa as well