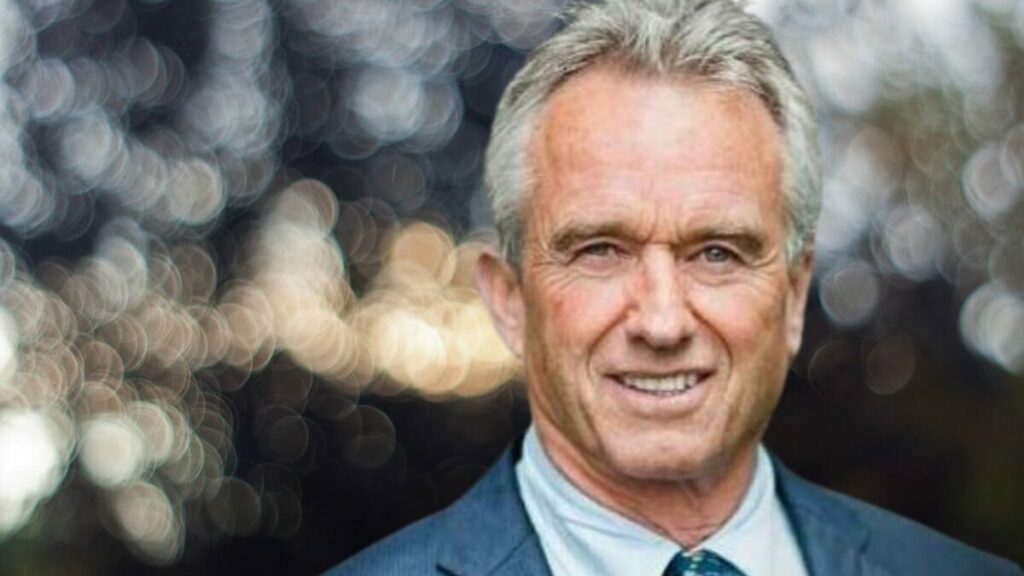

Nephew of former United States President John F. Kennedy and son of former Senator Robert F. Kennedy, Robert F. Kennedy Jr, has just voiced out his support for Bitcoin (BTC) and lambast Central Bank Digital Currencies (CBDC).

Vocal For Bitcoin

On April 11, Kennedy Jr. took to Twitter to argue that, Bitcoin (BTC), along with other cryptocurrencies are less vulnerable to market volatility and government policies due to their decentralized nature. He highlighted these digital tokens provide a “safe haven” or act as an escape route for the public from the dangers of traditional financial bubbles.

The claim that FedNow is not the first step toward a CBDC would be more easily digestible were we not aware of the Biden administration’s steady barrage of hostile broadsides against cryptocurrencies.

Between 2008-22, the Fed partnered with a handful of big banks to print $10…

— Robert F. Kennedy Jr (@RobertKennedyJr) April 10, 2023

He explained that with Bitcoin, people get the liberty to exchange value without intermediaries which translates to greater control of funds and lower fees. It’s faster, cheaper, more secure, and immutable. Kennedy Jr. claimed, there are no boundaries to Bitcoin or any other cryptocurrency with zero exchange values and no third-party interventions. He wrote,

“Cryptocurrencies like Bitcoin give the public an escape route from the splatter zone when this bubble invariably bursts. So the White House is colluding with the banksters to keep us all trapped in the bubble of profiteering and control.

Experts Explain Growing Interest in Crypto

Following the banking crisis, several analysts have chimed in to support digital currencies over the legacy financial system. The collapse of prominent banks such as Silicon Valley Bank, (SVB), Signature Bank, and Credit Suisse has rekindled the importance of crypto and decentralized finance (DeFi).

Recently, Bernstein analysts have argued that favoring gold but not Bitcoin (BTC) is irrational. Analysts at Bernstein compared the world’s largest cryptocurrency to a “faster horse” compared to gold. It seems Bitcoin’s recent rally above the $30,000 mark has further fueled the conversation around the digital asset’s potential as a store of value.

Richard Mico, chief legal officer of Vancouver-headquartered FinTech firm Banxa predicted that Bitcoin will continue to be the best-performing asset of 2023 attributing the rally to growing expectations of a slowdown in economic growth and a subsequent loosening of monetary policy by the Federal Reserve throughout the first quarter of this year.

Meanwhile, in a recent interview, Larry Lepard, managing partner at Boston-based investment management firm Equity Management Associates stated the U.S. dollar would collapse within the next decade. This collapse, he believes, will significantly boost the price of Bitcoin (BTC). He believes the BTC price will continue to climb, potentially hitting $100,000, then $1 million, and eventually reaching an astounding $10 million per coin.

On the other hand, Samson Mow, a former CSO of Blockstream and the Chief Architect of El Salvador’s Volcano Bitcoin Bond wrote,

“They threw everything they had at Bitcoin and then we just went right back to $30k. Can’t stop the inevitable.”

Kennedy Jr. Slams CBDC

Apart from advocating Bitcoin (BTC), Kennedy Jr. also criticized the Federal Reserve’s Fednow system and CBDCs. FedNow is a real-time payment system supported by a version of a central bank digital currency.

The US Presidential candidate, policy changes outlined his concerns about the Fed’s monetary policies and its relationship with big banks, claiming that, the Fed’s alleged “collusion” with big banks has led to the printing of $10 trillion in wealth over the past 15 years, which has primarily benefited the so-called “Banksters” at the expense of the public. Kennedy Jr. tweeted,

“We should be wary since CBDCs are the ultimate mechanisms for social surveillance and control.”

Kennedy’s concerns align with those of Florida Governor Ron DeSantis, who railed against the notion of a CBDC in the State last month. He speculated the technology could be used to curtail firearm purchases or limit gasoline sales. Hence, he put forth a proposal in March to outlaw the use of CBDCs as money in his state.

It is not merely “ideal” that major changes in policy receive specific authorization from Congress; it is constitutionally required.

Unaccountable institutions cannot impose a CBDC on Americans. They will tell us that CBDC won’t be abused but we are wise enough to know better.… https://t.co/OqJ27Lym2L

— Ron DeSantis (@GovRonDeSantis) April 10, 2023

Over the recent few months, other Republican lawmakers have also raised notable concerns about CBDCs, including Republican House Majority Whip Tom Emmer and South Dakota Governor Kristi Noem. In addition, U.S. Senator Ted Cruz had also recently submitted a bill to prohibit the Federal Reserve from developing a direct-to-consumer CBDC.