TL;DR

- Upexi has expanded its Solana holdings by 4.4%, reaching over 2.1 million SOL, adding roughly 88,750 SOL since September.

- Despite the increase, a recent crypto market pullback cut the value of its holdings to around $340 million, reducing unrealized gains to $15 million.

- Nearly all SOL is staked, generating 7%–8% annual yield, with 42% of holdings purchased at a discounted price, offering built-in returns for shareholders.

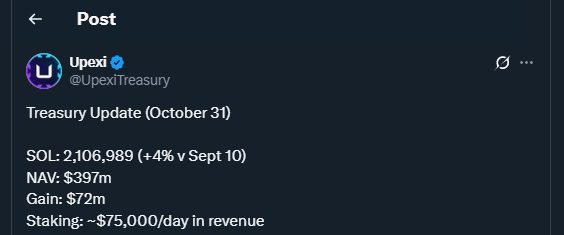

Upexi , a Solana-focused treasury management company, has increased its SOL holdings to 2,106,989, marking a 4.4% growth since September 10. The additional 88,750 SOL brings the total value of its portfolio to approximately $397 million based on the end-of-month price of $188.56. At the same time, the company’s unrealized gains remain significant at $72 million compared to the $325 million total cost of its treasury. Analysts note that this growth demonstrates the firm’s disciplined approach to strategic crypto acquisitions, highlighting management’s confidence despite recent volatility.

However, the broader crypto market pulled back sharply this Monday, driving Solana’s price down to $164.12. This decline temporarily reduced the value of Upexi’s holdings to $340 million and trimmed unrealized gains to around $15 million. Upexi’s stock has also felt pressure, reflecting a 75% drop from previous highs, resulting in a market cap-to-net asset value ratio of roughly 0.7. CEO Allan Marshall emphasized that the company remains focused on long-term shareholder value through strategic growth in Solana, while also maintaining flexibility to adapt its treasury strategy as market conditions evolve.

Staking Rewards and Strategic Gains Support Revenue

Nearly all of Upexi’s Solana is staked, providing a 7%–8% annualized yield and generating roughly $75,000 daily in revenue. About 42% of the holdings are locked SOL purchased at a double-digit discount, effectively creating “built-in gains” for investors. The firm’s adjusted SOL per share has increased to 0.0187, representing a 47% growth in Solana terms and an 82% rise in dollar value since the treasury strategy launched in April through a $100 million private placement led by GSR. Market observers highlight that the combination of staking rewards and strategic acquisitions strengthens the company’s financial position, making it better positioned to capitalize on future Solana price appreciation.

Investors who bought Upexi shares at $2.28 have seen a 96% return, far outpacing Solana’s 24% gain over the same period. Chief Strategy Officer Brian Rudick highlighted that the company maintains a strong trading multiple, which the firm plans to leverage further to benefit shareholders.