TL;DR

- Uniswap Labs has launched “The Compact,” an open-source system that enhances interoperability between blockchains and allows apps and digital assets to move securely.

- The system uses ERC6909 tokens to commit assets for cross-chain operations or swaps, keeping users in control while preventing the typical fragmentation seen in the DeFi market.

- UNI is trading at $7.88 after losing nearly 20% in the past month; breaking the $8.40 resistance could fuel gains toward $12 and $18.

Uniswap Labs introduced “The Compact,” an open-source contract system designed to improve interoperability across blockchains, enabling applications and digital assets to move between different chains safely and seamlessly.

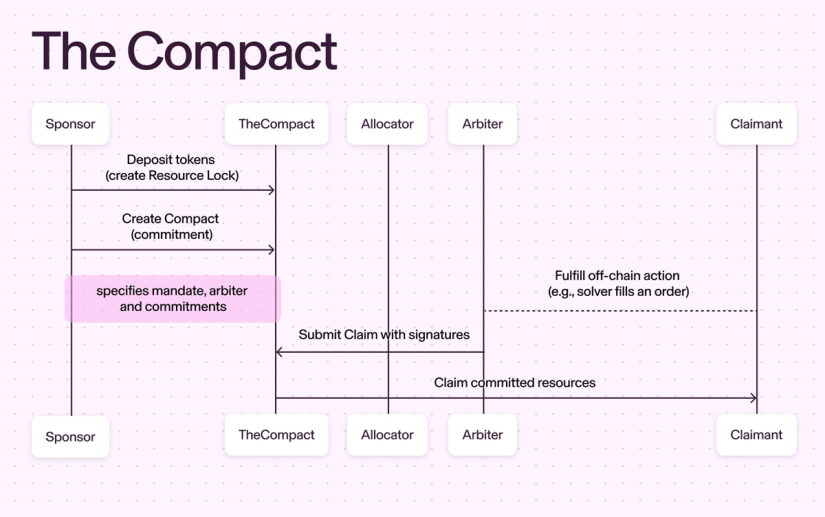

The new feature introduces a shared mechanism to prevent fragmentation across decentralized platforms and allows developers to use, adapt, and trust a common infrastructure, eliminating the need for each project to build its own bridges or escrow systems.

How Does ‘The Compact’ Work?

The system allows users to “commit” tokens for specific actions, such as cross-chain operations or swaps, while maintaining control of the assets through ERC6909 tokens representing the locked assets. This architecture ensures that resources can move freely between chains, providing simple and declarative compatibility for users without sacrificing decentralization or ecosystem security.

The initiative aims to address the fragmentation issues that have historically affected the DeFi ecosystem, where multiple blockchains, sidechains, and rollups have different standards and tools, creating challenges for users and duplicated infrastructure for developers. With The Compact, protocols can offer cross-chain functionalities without compromising security, enabling decentralized applications to interact more efficiently and reliably.

Uniswap Faces Market Volatility

Meanwhile, Uniswap’s token, UNI, has shown some instability recently, trading at $7.88 after losing nearly 20% over the past month. Surpassing the $8.40 resistance could support a rally toward $12 or even $18