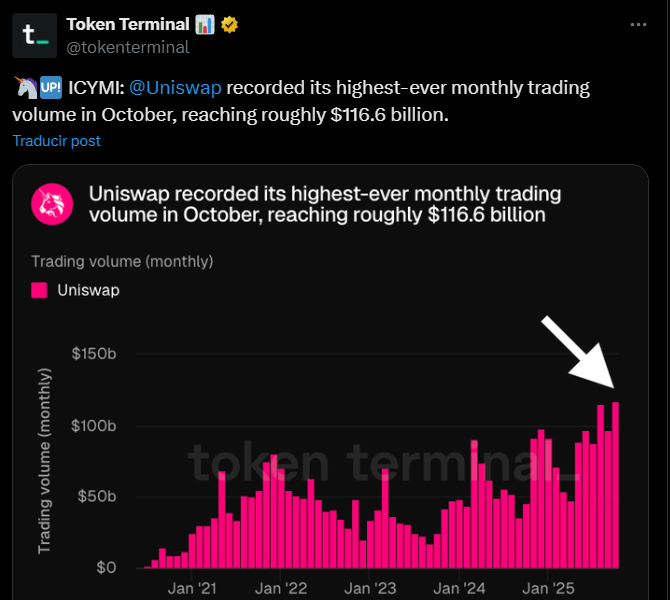

Uniswap recorded a record trading volume of $116.6 billion in October, its highest monthly level since launch. Growth was concentrated in the protocol’s V3 and V4 versions and on networks such as Ethereum, Base, and Arbitrum, which lowered costs and expanded on-chain liquidity.

The activity also reflected an increase in whale transactions and in UNI token turnover following the proposal to burn 100 million tokens, which pushed its price up more than 70% in recent weeks.

Analysts link the surge to renewed institutional interest in decentralized trading. If the trend continues, Uniswap could surpass $1 trillion in annual trading volume for the first time, solidifying its position as one of the most important infrastructures in the DeFi market.

Source: https://x.com/tokenterminal/status/1988346562272010708

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions.