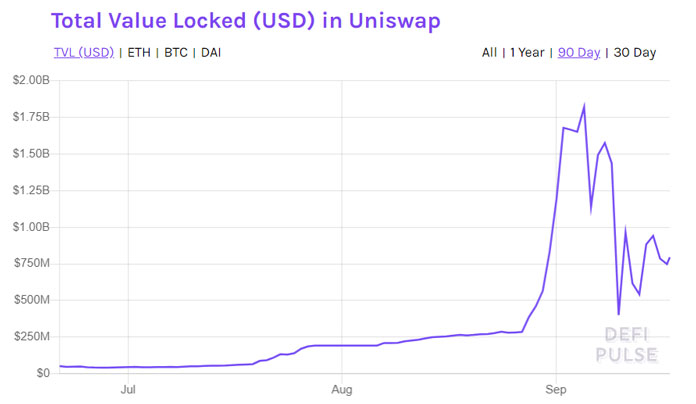

The cryptocurrency community was heavily surprised this morning as DeFi’s leading decentralized exchange announced an airdrop worth $1200. Comparable to the Bitcoin Cash ‘airdrop’ a few years ago, UNI will surely stand in the center of attention for weeks if not months.

However, how bullish or bearish is this event exactly? While everyone is surely glad to receive $1200 for doing nothing more than using a DEX, there are still some points that need to be considered when taking a look at the bigger picture in play.

First, Uniswap is surely on the road to becoming the so-called King of DeFi. Developed for more than two years, the fully decentralized trading and liquidity mining protocol just got a major upgrade. With a new native token and a governance model, Uniswap may be able to achieve what SushiSwap’s developer tried to do when copying from the original source.

As a reminder, SushiSwap reached $15 on launch day, grabbing liquidity from all other platforms within the ecosystem. However, the saga of SushiSwap is filled with drama, suspicious actors, and a community that is tired of everything crypto-related.

With this in mind, it is easy to see how Uniswap can surpass what SushiSwap build in its first week with a drama-free community. Moreover, the developer-base within Uniswap has been working hard to bring their product to fruition, working with many financial entities in the meantime. With their accumulated experience, Uniswap devs have the chance to make their exchange number one in DeFi once and for all.

Bearish or bullish tone for the rest of Crypto?

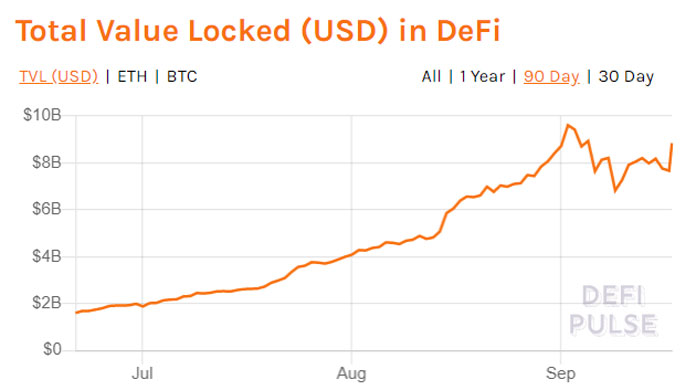

At the same time, one may wonder what precedent the listing and airdrop may set for not only DeFi but the entire cryptocurrency sector as well. The DeFi bubble had a healthy correction and users are now back to yield farming. However, Bitcoin and Ethereum are struggling to reach previous highs, failing to flip resistances into support levels. Just yesterday, Bitcoin failed to pump beyond $11,000 despite the Federal Reserve announcing no significant degree of inflation for the next few years.

Moreover, the problem of scalability and high gas fees still haunts investors to this day. Compared to the correction at the start of September and today, nothing effectively changed. With enough activity, both in transactions and yield farming, Ethereum gas fees will return to an unsustainable rate of $30 to $40.

After the UNI airdrop this morning, Gwei fees almost tripled in a matter of hours following a rush where investors claimed their rewards. Apart from high fees, the event also led to high network congestion where users had to wait more than hours to transfer rewards to other wallets.

If traders, investors, and farmers would all jump onto the Uniswap bandwagon now, it would have a severe backlash on the rest of the sector. Moreover, it would also negatively affect Uniswap as it would show how unsustainable its services are for the average user.

Terrible Price Action

On that account, bullish investors should step away and take a better look. Macro cryptocurrencies are struggling to gain interest from retail and institutional investors. Any significant drop in Bitcoin’s price will highly impact the financial incentive for yield farming. In the end, yield farming is basically DeFi and when it dies, DeFi dies as well.

Data from DeFi Pulse shows that investors locked around $8.48 billion in collateral. On Sep 1, a $2000 Bitcoin move down resulted in DeFi losing almost $3 billion assets. Effectively, a -16.6% move on Bitcoin resulted in a -29.17% decrease in DeFi collateral. You can guess how the decentralized ecosystem stands to lose if Bitcoin were to fall to $9000 or even $7000.

Steer your focus away from crypto

The situation may or may not seem bearish for cryptocurrencies. However, we need to remind ourselves that there is much more happening outside our digital finance ecosystem. Outside, the world battles with a global pandemic, political division in the U.S. along with violent protests, record-high debt, and unemployment. To put a cherry on the top, we also have a potential market bubble with a high risk of global warfare due to increasing geopolitical tensions between the U.S. and China.

All in all, the global situation definitely does not spell ‘buy’ for investors. The macro outlook is very severe and can have a significant impact not only on our investments but on our job prospects as well. Markets fare best during stability and 2020 certainly is not known for being stable.

If you found this article interesting, here you can find more DeFi News