As DeFi project fever sweeps across the market, the charts for both Uniswap and XRP are flashing danger signals. With traders rotating out of well-known names and hunting for the next big altcoin in 2025, fear of missing out is driving activity.

Meanwhile, a lesser-known yet fast-growing venture backed by massive demand is quietly positioning as one of the best crypto to buy now and smart early buyers are already eyeing the opportunity hard.

Uniswap: Chart Breakdown Suggests 50% Downside

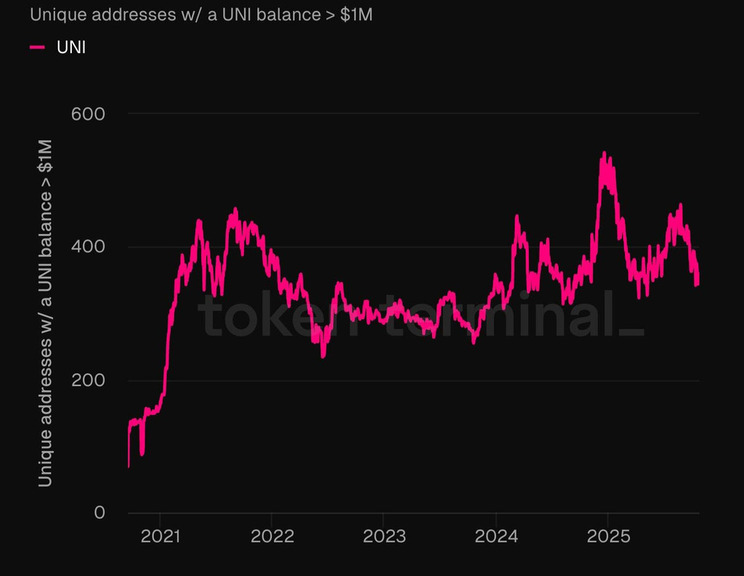

Uniswap, often seen as a flagship for decentralized exchange protocols, is now flashing red. Technical data shows UNI is in a ‘Strong Sell’ status across the daily timeframe. This suggests UNI may face a sharp correction. Analysts are already whispering that liquidity fatigue has set in for this layer-2 Ethereum alternative and top DeFi altcoin.

Multiple indicators show price compression and risk of a breakdown. If UNI breaks below key support zones, the drop could approach 50%. Large holders seem to be rotating out, seeing UNI as less of a bet and more of a risk. For early stage crypto investment hunters, the warning is clear: don’t assume all DeFi projects are safe.

Given that Uniswap is also a key player in cross-chain DeFi projects and low gas fee crypto ecosystems, a weak showing here could ripple. The shift of funds away from UNI strengthens the case for seeking the next undervalued crypto project.

XRP: Holding But Uneasy as Support Hangs by a Thread

XRP has held up relatively well compared with Uni, yet the technicals show the balance might tip the wrong way. According to recent price analysis, XRP reclaimed its 200-day moving average but is consolidating below a critical supply zone around $2.70. Meanwhile, a fresh analysis on key levels shows the token trading above EMA20 (2.57) but still under EMA50/EMA200 clusters (2.68).

But the trap is that if XRP fails to close convincingly above the 2.68-2.70 barrier, it could slide back toward 2.40 or lower. The fractal long-term chart for XRP projects potential toward $7 and possibly $11-$15 in the upcoming bull phase. Yet that scenario only works if the current risk is managed.

Remittix Gear Shift: Why This Emerging Altcoin Demands a Look

Remittix has already raised $27.7 million in private funding, signifying strong demand from early backers. With the major coins showing signs of stress, the moment for a fresh high-growth crypto to shine is now.

Compared with legacy tokens like Uniswap and XRP, this project is designed for borderless real-world payments, not just speculation. Early testimonials suggest it could become the bridge between crypto and traditional fiat — a clear differentiator.

Why this project is gaining traction:

- Global Reach: Built to support transfers directly to bank accounts in 30+ countries.

- Real-World Utility: Designed first for payments and remittances, not just token hype.

- Security First: Audited and verified by a top blockchain security firm.

- Wallet Coming Soon: Mobile-first experience with real-time FX conversion for users.

- Funded Strongly: $27.7 million raised in private rounds shows deep institutional interest.

When matched against established names, the case is clear: while Uniswap and XRP battle structural risks, this alternative has cleaner utility, less baggage, and a thinner supply — making it more appealing for investors seeking the next best crypto to buy now. Don’t view it as a replacement; view it as an addition to a portfolio in flux.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io

Socials: https://linktr.ee/remittix

$250, 000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.