TL;DR

- The FHFA announced it will evaluate including cryptocurrencies in mortgage qualification processes, a decision that could affect millions of loans.

- Bill Pulte, the agency’s director and a holder of Bitcoin and Solana, confirmed the study but gave no details on timelines, criteria, or which assets might be considered.

- The announcement signals growing institutional interest in integrating digital assets into traditional financing systems.

The U.S. Federal Housing Finance Agency (FHFA) announced it will study the potential inclusion of cryptocurrency holdings in the mortgage qualification process.

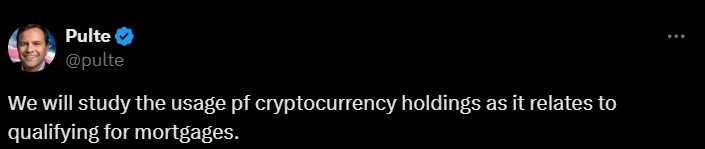

The initiative was confirmed by its director, Bill Pulte, who posted a short message on X stating that the agency would explore how to factor in these assets when determining applicant eligibility.

The FHFA oversees core entities within the U.S. mortgage system, including Fannie Mae, Freddie Mac, and the Federal Home Loan Banks. Any adjustment to its qualification standards could directly impact millions of credit operations nationwide. This announcement signals a shift in institutional interest toward using digital assets as part of the asset base in traditional financing structures.

No Details Yet on Which Cryptocurrencies Might Be Considered

For now, Pulte has not disclosed which cryptocurrencies will be included in the review or what criteria will be used to evaluate them. He also did not provide a timeline or outline how the study will be conducted. The agency declined further comment, though the announcement drew immediate attention within both the crypto market and traditional financial services sectors.

The current FHFA director took office in March 2025 after being nominated by Donald Trump in January. Pulte has maintained a public connection to the crypto market for several years. In 2019, he announced the purchase of 11 BTC, and according to his latest financial disclosure in February, he holds Bitcoin and Solana valued between $500,001 and $1 million. He also reported holding shares in MARA Holdings, a firm focused on Bitcoin mining operations.

The FHFA joins a growing list of regulators and traditional financial institutions examining how to integrate digital assets into conventional financing systems. Still, regulatory treatment of cryptocurrencies in lending processes remains uncertain and highly fragmented depending on the jurisdiction and type of operation. Although preliminary, this study confirms that U.S. authorities are starting to more actively consider the asset value of cryptocurrencies in financial decision-making.