TL;DR

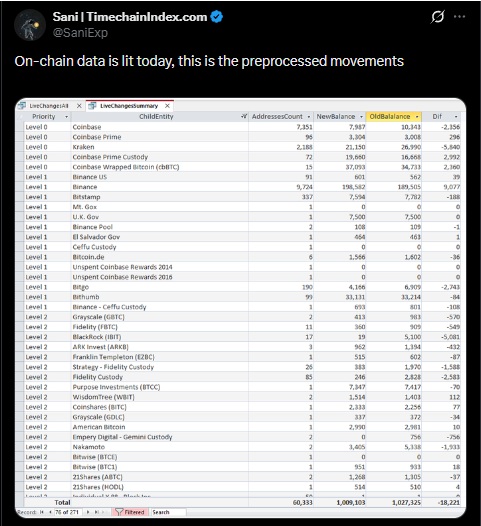

- Several Bitcoin treasury companies moved 18,221 BTC, including Nakamoto, BlackRock, WisdomTree, 21Shares, and Ark Invest.

- Strategy transferred BTC from its custody at Fidelity and states it remains solvent despite losses. Meanwhile, traders sent over 9,000 BTC to Binance.

- Bitcoin has recovered, reaching $70,000, with a daily trading volume of $139 billion after a 37% increase, but open interest remains low.

Several Bitcoin treasury companies registered asset movements during the latest market downturn, according to on-chain data. Nakamoto (NAKA) moved 1,933 BTC from its treasury, which totals 5,398 BTC. The company holds a $210 million BTC-backed loan with Kraken, and part of its balance was transferred to cover obligations.

Strategy also moved BTC from its Fidelity custody, although there is no direct evidence of liquidations. The company states it can operate solvently even if Bitcoin falls to $8,000, despite recording significant losses on its position.

Which Treasuries Acted During Bitcoin’s Latest Drop?

Other firms that registered BTC outflows included BlackRock (IBIT), which sold 5,081 coins, WisdomTree with 122 BTC, 21Shares with 37 BTC, and Ark Invest with 432 BTC. In total, treasury and institutional wallet operations amounted to 18,221 BTC, extending the capitulation trend observed over the past few days.

Over 9,000 BTC flowed into Binance, reflecting strong active participation by traders during the heavy selling pressure. Treasury outflows represent a smaller volume compared to other transactions but affect market structure by redistributing strategic positions.

Recent BTC behavior shows the market remains dominated by fear and low open interest, with no signs of new long position accumulation or trading activity that clarifies market direction. Fluctuations within the current price range could precede additional liquidation activity and adjustments in treasury balances.

Bitcoin Recovery

Data highlights that companies with significant reserves continue actively managing their positions. The focus is on liquidity, credit obligations, and maintaining solvency amid Bitcoin volatility.

According to the latest CoinMarketCap data, Bitcoin has recovered to around $70,000 per coin, rising 6% in the last 24 hours. Daily trading volume surged 37%, exceeding $139 billion