Cryptocurrencies have been promoted as financial privacy tools, but most public blockchains, including Bitcoin and Ethereum, are not anonymous. Although addresses are not directly linked to personal identities, transaction history is transparent and traceable. This limitation has driven the development of privacy solutions like Tornado Cash, a decentralized protocol that uses cryptographic proofs to break the link between the source and destination of funds.

What is Tornado Cash?

Tornado Cash is a decentralized and non-custodial protocol designed to enhance transaction privacy on Ethereum. It relies on smart contracts that allow users to deposit funds and withdraw them to a new address without any link between the two operations. Its functionality is inspired by research from the Zcash team and applies zero-knowledge proofs (zk-SNARKs) to ensure transaction anonymity.

Unlike traditional mixers, which rely on a centralized entity to manage funds, Tornado Cash operates without intermediaries. In May 2020, its development team relinquished control over the smart contracts in a Trusted Setup Ceremony, making it an autonomous protocol governed by its community.

How Does Tornado Cash Work?

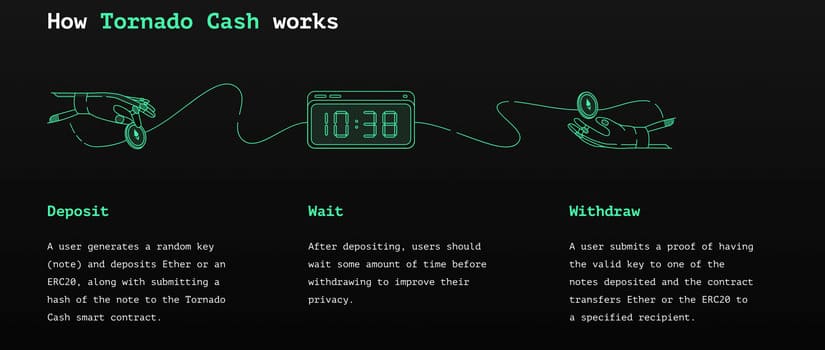

Tornado Cash uses zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge) to conceal the relationship between deposits and withdrawals. Simply put, a zk-SNARK allows someone to prove that a statement is true without revealing any additional information about it.

When a user deposits ETH or an ERC-20 token, the smart contract generates a “secret” and its corresponding hash, known as a “commitment.” This commitment is stored in the contract, while the user retains the secret. To withdraw the funds, the user must provide a cryptographic proof based on zk-SNARKs, demonstrating that they possess a valid secret without revealing what it is. This prevents external observers from linking the withdrawal transaction to the deposit.

Anonymity Set

The level of privacy in Tornado Cash depends on the size of its Anonymity Set, which represents the total number of deposits within the smart contract. The larger the anonymity set, the harder it is to trace a specific transaction. If few users interact with the protocol, the chances of correlating deposits and withdrawals increase, reducing the effectiveness of anonymity.

To improve privacy, users can wait before withdrawing their funds, allowing more deposits to accumulate in the contract. It is also recommended to split withdrawals into multiple transactions and use non-rounded amounts to avoid predictable patterns.

Relayers and IP Address Protection

If a user withdraws funds directly to a new address, they must sign the transaction with their private key, which could reveal a connection between their blockchain identities. To circumvent this issue, Tornado Cash implements a relayer system. These intermediaries process withdrawals on behalf of users without knowing their identities. In return, relayers charge a fee paid in ETH.

However, blockchain privacy does not guarantee anonymity at the network level. Without additional measures, an attacker could trace the user’s IP address and link it to a specific transaction. To prevent this, the protocol recommends using a VPN, Tor, or a proxy.

Anonymity Mining

To incentivize protocol usage and expand the Anonymity Set, Tornado Cash introduced a reward mechanism called Anonymity Mining. In this system, users who deposit funds generate “anonymity points” stored in a protected account. Once a sufficient amount of these points is accumulated, they can be converted into TORN tokens through a private claim transaction. This system prevents users from revealing how long they have kept their deposits in the contract, preserving privacy in the token mining process.

The TORN Token: What Is It and What Is It For?

Tornado Cash operates under a decentralized governance model driven by its community, where decisions about the platform’s evolution depend on voting by TORN token holders. This ERC-20 asset plays a fundamental role in the protocol’s financial ecosystem.

From a technical perspective, TORN also enables the protocol’s operational decentralization. As an autonomous system where smart contracts function without third-party intervention, TORN-based governance prevents the existence of a central entity with control over Tornado Cash. This strengthens the protocol’s resistance to censorship and regulatory attacks, which has become a crucial aspect following sanctions imposed by organizations like OFAC.

Is TORN a Good Investment?

Regarding its viability as an investment, the token’s performance has been influenced by external factors, particularly regulatory uncertainty. While TORN has utility within the ecosystem, its market value has experienced high volatility due to a decline in protocol usage following the restrictions imposed in 2022.

The removal of TORN from several exchanges has reduced its liquidity, limiting its attractiveness to short-term investors. However, its long-term potential will depend on the evolution of blockchain privacy and Tornado Cash’s ability to maintain relevance within Ethereum. Investing in TORN carries high risks. Its future adoption is subject not only to the project’s technological viability but also to the acceptance of privacy solutions.

The Tornado Cash Case

The use of Tornado Cash has sparked intense debate in regulatory circles. As a tool that enhances financial privacy, some governments and enforcement agencies have associated it with illicit activities such as money laundering.

In August 2022, the U.S. Office of Foreign Assets Control (OFAC) sanctioned the protocol, prohibiting U.S. companies and citizens from using it. This measure blocked access to the protocol’s official interface, although its smart contracts continue to operate on the Ethereum blockchain.

The decentralization of Tornado Cash prevents its developers from disabling the protocol or altering its code. However, regulatory restrictions have limited its adoption in regulated markets and led to the exclusion of the TORN token from several exchanges.

Limitations

- Dependence on Anonymity Set Size: The effectiveness of Tornado Cash depends on the number of active users. If the anonymity set is small, privacy is reduced, as it becomes easier to correlate deposits and withdrawals. This is especially problematic for transactions with unusual amounts, which may stand out within the transaction pool. Without a constant flow of new deposits, the protocol’s utility could decline over time.

- Security and Self-Custody: Tornado Cash requires users to securely store the “secrets” generated when depositing funds. If a user loses this data, they will not be able to recover their assets. Additionally, the protocol’s decentralization means there is no customer support service or entity responsible for reversing transactions or resolving errors.

Conclusion

Tornado Cash provides an unprecedented level of privacy, offering a solution capable of hiding the link between deposits and withdrawals. Its community governance model and anonymity mechanisms have given it a high degree of decentralization.

However, the protocol must contend with regulatory limitations and relies on high activity levels to maintain its effectiveness. While it remains one of the best privacy tools on Ethereum, its future depends on the evolution of the legal framework and users’ willingness to continue using it despite imposed restrictions.

Tornado Cash demonstrates that privacy on blockchain is technically possible, but its widespread acceptance will depend on its ability to balance decentralization with regulatory demands