TL;DR:

- The XRPL will host phase two of Dubai’s real estate tokenization project, opening the door to a controlled secondary market.

- Around 7.8 million tokens issued during the pilot are now eligible for resale.

- The project involves the Dubai Land Department, Ripple Custody, and Ctrl Alt as tokenization infrastructure.

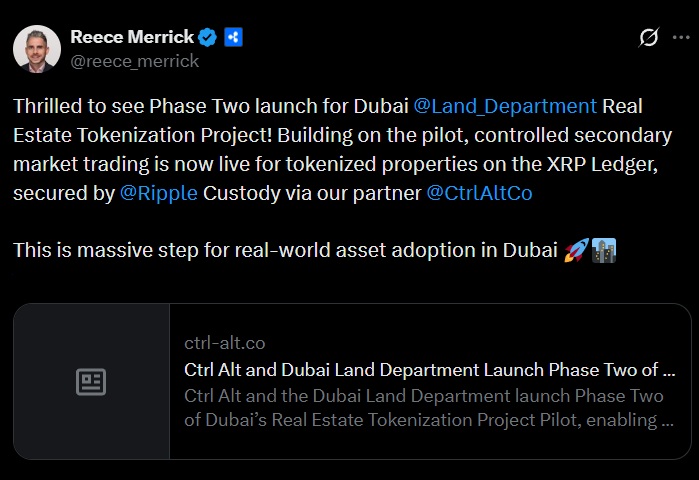

Reece Merrick, senior executive at Ripple, announced the launch of phase two of Dubai’s real estate tokenization project on the XRPL. The most significant development is the activation of a controlled secondary market that allows investors to resell fractional shares of properties within a regulated framework.

The project is the result of a joint effort between the Dubai Land Department, Ripple Custody, and Ctrl Alt, a tokenization infrastructure provider that integrated its engine directly with the city’s land registry processes. This allows property titles to be issued, managed, and transferred on-chain through the XRPL. All transactions are recorded and secured through Ripple Custody’s infrastructure.

A Secondary Market with Its Own Rules

Phase two builds on a successful pilot in which ten properties valued at over $5 million were tokenized. Approximately 7.8 million tokens were generated during the initial stage and are now available for resale. This move is aimed at expanding liquidity and accessibility in the real estate market of the Emirati city.

Merrick emphasized that the primary goal of the controlled secondary market is to assess the system’s operational readiness while reinforcing standards of transparency, governance, and investor protection. This marketplace is a supervised environment designed to validate the model ahead of a potential broader rollout.

XRPL Receives Explicit Regulatory Backing

Ctrl Alt’s integration with the Dubai land registry represents a fundamental step forward in the institutional adoption of real-world assets on blockchain infrastructure. The city has become a global reference point for tokenized real estate markets. The tokenization of physical assets is gaining traction among regulators and institutional investors across different regions. The choice of the XRPL as the settlement layer underscores its relevance as a network with multiple financial use cases and explicit regulatory support.