TL;DR

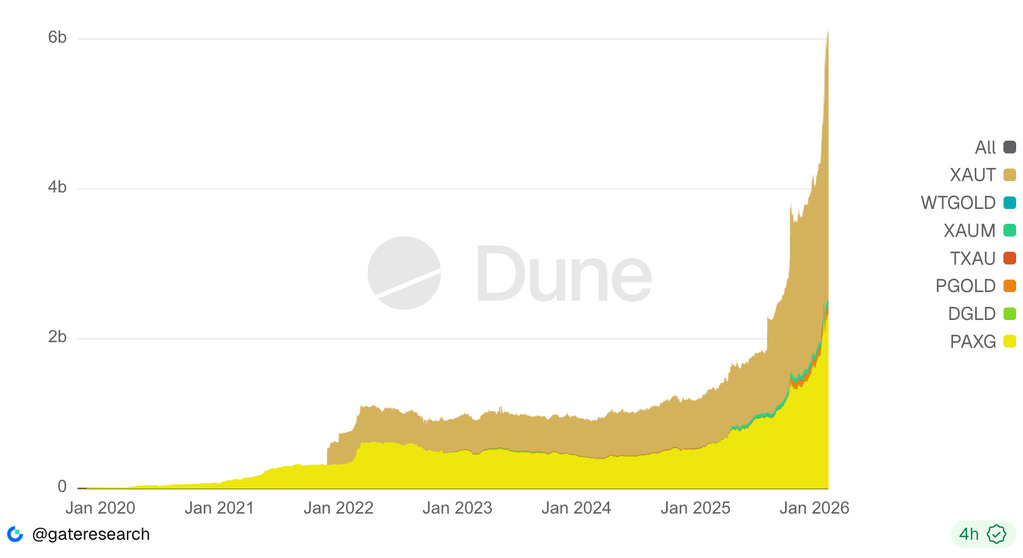

- The tokenized gold market surpasses $6 billion in capitalization, led by XAUT and PAXG.

- XAUT reaches $3.5 billion and PAXG $2.3 billion, both growing over 30% in one month.

- Tether added 27 metric tons of gold in Q4 2025, outpacing sovereign buyers like Greece.

The tokenized gold market crossed $6 billion in capitalization, expanding more than $2 billion since the beginning of the year despite sharp volatility in physical gold prices. More than 1.2 million ounces of physical gold now sit in custody backing digital tokens on blockchain infrastructure.

Tether Gold (XAUT) dominates the sector with a market cap of $3.5 billion, representing over half the total market. The token’s capitalization surged more than 50% over the past month alone, according to DUNE. Paxos-issued PAX Gold (PAXG) ranks second with $2.3 billion, climbing 33.2% in the same period. Together, XAUT and PAXG account for the majority of activity in tokenized gold markets.

Tether accelerated its gold accumulation during the last quarter of 2025, adding 27 metric tons to its fund exposure — reportedly outpacing sovereign buyers like Greece, Qatar, and Australia. CEO Paolo Ardoino stated the company plans to increase gold exposure to 10-15% of its overall investment portfolio.

Introducing Scudo.

A new way to measure the value of gold on-chain. Scudo is a simple, intuitive unit that makes Tether Gold ( XAU₮) easier to use, track, and transact.1 Scudo = 1/1000 of an XAU₮ (Gold Ounce), giving you a practical and accessible way to send and receive gold… pic.twitter.com/DahNgDeBvm

— Tether Gold (@tethergold) February 12, 2026

The firm also invested $150 million in precious metals platform Gold.com, acquiring approximately 12% ownership. The partnership will integrate XAUT into Gold.com’s platform and explore options for customers to purchase physical gold using USD₮ and USA₮, Tether’s dollar-backed stablecoins. Tether additionally launched Scudo, a measurement unit representing 1/1,000 of an XAUT.

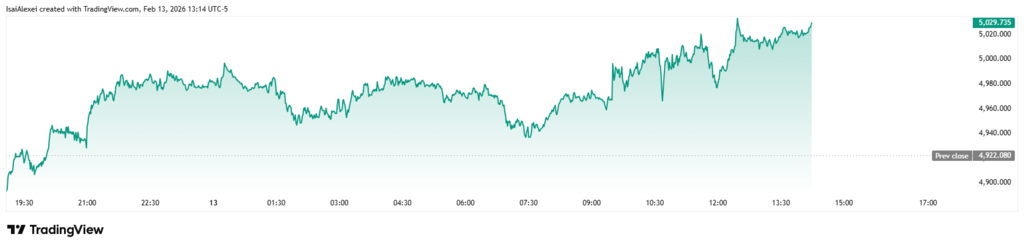

Physical Gold Volatility Spikes After Record High at $5,602 Per Ounce

Physical gold prices experienced sharp swings in recent sessions. After reaching an all-time high of $5,602 per ounce on January 29, prices corrected to a low of $4,402 on February 2 — a drop exceeding 20% in four days. Following a partial recovery, renewed selling pressure emerged, with spot gold falling over 3% and silver declining more than 10% amid escalating economic stress.

The tokenized gold sector continued expanding through the volatility, demonstrating demand for blockchain-based gold exposure even as physical markets experienced extreme price action.