Liquidity pools are one of the most chosen instruments by investors for their cryptocurrency investments. However, many follow such common strategies that make the returns much lower than they should be.

Therefore, in this article we are going to show you 3 liquidity pools within the Ethereum Blockchain, the most important for DeFi investments, with very good returns. Moreover, we will show you step by step how we have done the research to find these hidden investments.

In addition, you will see all the calculations we have done and how to filter out pools that might look extremely attractive but are so risky that they are not worth investing in.

If you want to know all the details of all the steps we are going to follow, we recommend you to read our article on the Secrets to Maximize your Cryptocurrency Investments with Liquidity Pools, and you will understand the whole process much better.

Looking for good liquidity pools

Usually, what any investor would do is to choose the first pool that shows the highest expected return. However, this can be a mistake, because if the amount of liquidity increases much more than the trading volume (as all liquidity providers will want to enter the same pool), returns will eventually plummet for everyone.

So, what strategies will we follow? Well, what we will do is look for pools that have low liquidity, but at the same time maintain high trading levels compared to the locked value. Always looking for cryptos or tokens that are reliable and preferably within the TOP 50 by market capitalization.

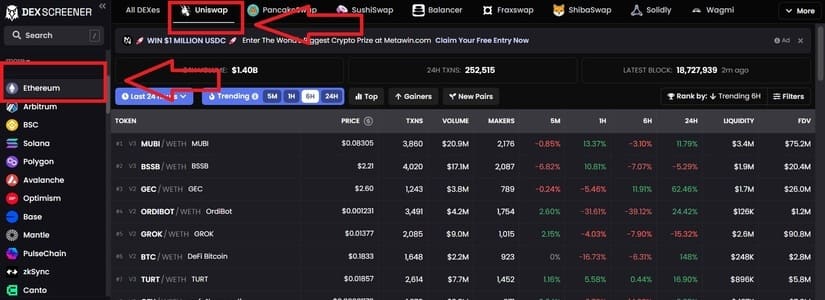

For that, we are going to use the DEX Screener platform, which gives us an overview of the different pools on various blockchains. In this case, we are going to choose the Ethereum blockchain and we are going to select the Uniswap Decentralized Exchange.

Here we see an extensive list of peers, some with well-known cryptocurrencies, and some with tokens that have virtually no circulation. Now, what we need is, first of all, to establish a filter by trading volume of the last 24 hours.

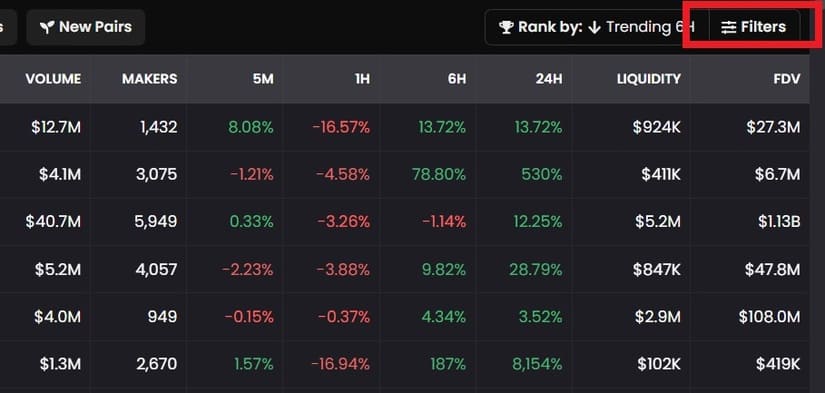

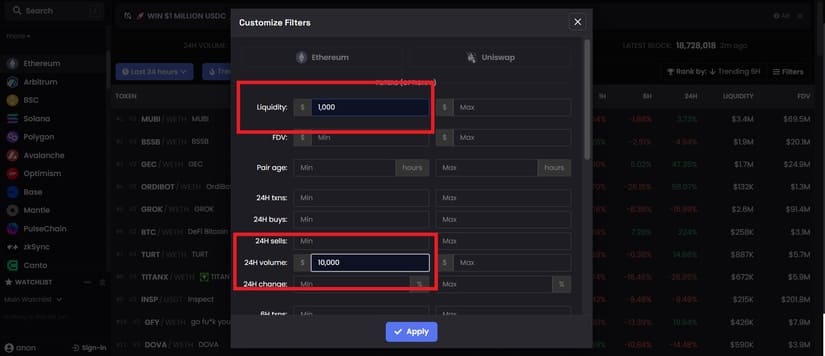

It is useless to find a pool with low liquidity, but with no movements. Therefore, we recommend setting a minimum trading volume of $10,000 and a liquidity of at least $1,000.

Once the filter has been applied, we will sort the results by liquidity in an increasing order, i.e., we will see first the pools with the lowest liquidity.

Now, what we need to find is, as we have already mentioned, pools that have low liquidity compared to the trading volume. The larger proportionally this difference is, the better. Although remember that the trading pair is composed of 2 major cryptos.

However, we must keep in mind one thing: there are cryptocurrency pairs that are either very new or extremely volatile, and it is not advisable to choose them, no matter how well they meet the above conditions. Since it is useless to find a pool that will make us lose the value of our investment due to a large correction in a very short time.

Having said that, we must take into account the variations in the prices of the last 24 hours, discarding those that have had excessive rises or falls in that period. This will drastically reduce the risk.

This analysis can be performed at any time and in any blockchain, although the results will change quickly due to the usual volatility of the cryptocurrency market.

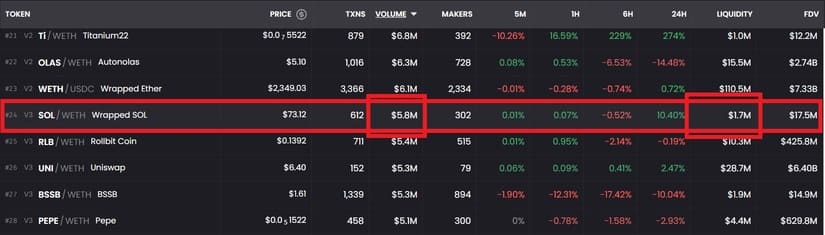

Following the steps we have seen above, we see how the liquidity for this pair is much lower than the trading volume. In this case, SOL / WETH has $1.7 million in liquidity, while the trading volume is 3 times higher: $5.8 million.

Once we have detected any pair that meets the requirements, we must go to the official uniswap information site, and then go to the pools section. Here we will find the information we need about the pool we had selected to calculate the real returns.

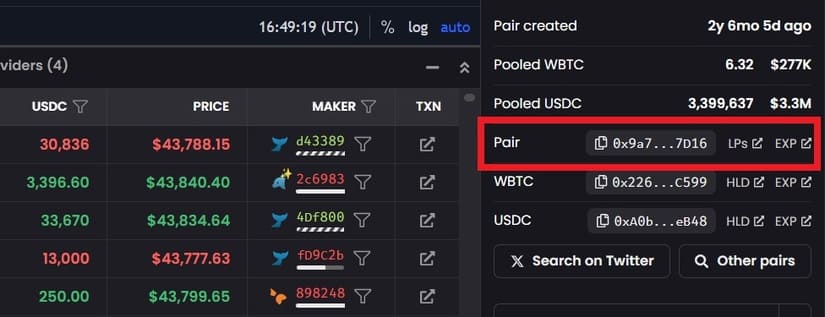

To simplify the search we give you a good tip: copy the address of the pair you have found in DEX Screener as you can see in the following image, and paste it after this link: https://info.uniswap.org/#/pools/

For example: https://info.uniswap.org/#/pools/0x9a772018fbd77fcd2d25657e5c547baff3fd7d16

Liquidity pools on ethereum with a return of more than 100% annually

Let’s look at 3 pools we have found that have good investment returns. They all have different level of risk and therefore different expected returns.

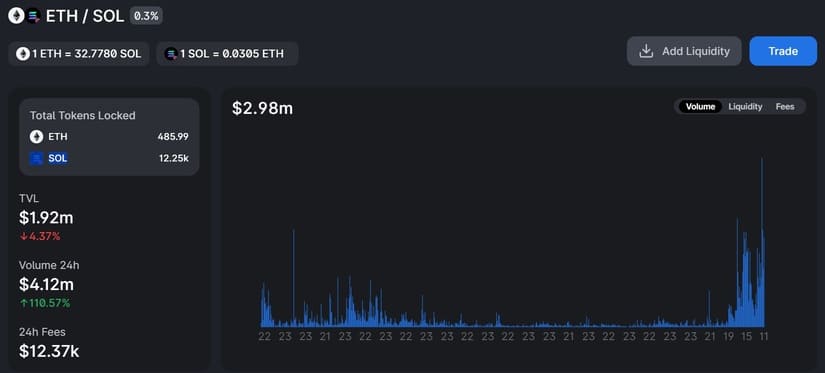

ETH / SOL

First we have found the Solana and Ethereum pair. This can be considered a low-risk investment, due to the fact that both are very solid cryptocurrencies.

To determine the profitability, we must take two pieces of information: the commissions generated the last 24 hours and the total locked value of the pool. Ideally, in both cases, we should take an average of both in the last 30 days, but for this didactic example we will take the current values.

After averaging, we get a TVL of $2,173,844 and daily commissions of $6,518. Then, the calculation we must make is as follows:

24 hours commissions / LTV x 365 days of the year x 100 = % of Profitability.

In this case:

6,518 / 2,173,844 x 365 x 100 = 109%.

In other words, the annual yield of this pool is an incredible 109%, which is extraordinary considering the pair that composes it.

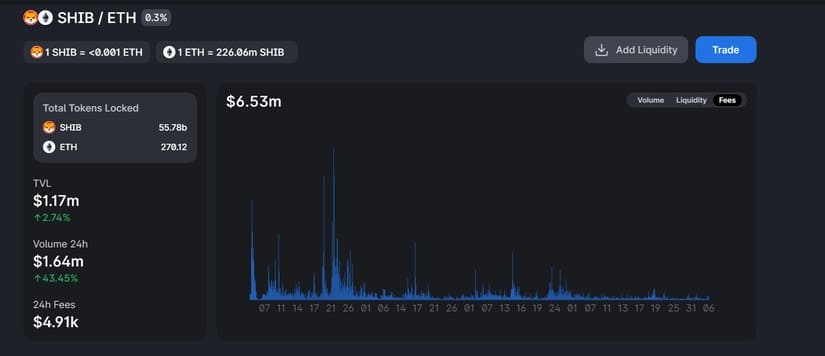

SHIB / ETH

Doing the same analysis on liquidity and volume in DEX Screener, we have come across the SHIB pair, a recognized memecoin of the most important in the market, and ETH, the leading altcoin.

After averaging roughly over the last 30 days, the TVL gives us about $695,000 and commissions generated of $2,000.

Using our formula:

2,000 / 695,000 x 365 x 100 = 105%.

Once again we find a return that exceeds 105% per year, although in this case, since it is a memecoin, we must take into account that its volatility can be high and, therefore, its risk is higher.

PEPE / ETH

In our search through the Ethereum blockchain pools, we have found another more than interesting alternative. In this case, the PEPE and Ethereum pair. Being another memecoin and relatively new, its volatility is even higher and, as a consequence, we must be alert to the risk involved.

After calculating the average of the last few days, as we have been doing, we obtain a total blocked value of $6,750,000 and fees of $20,000.

Let’s look at the returns using our formula:

20,000 / 6,750,000 x 365 x 100 = 109%.

As we can see, this pool has an annual return of almost 110%. Although, as we have said, this has to be seen relatively, since PEPE being such a volatile memecoin, it can make that yield end up being very different.

This is exactly why, the next thing we should do for all our pools is to set ourselves a price range between which we are going to trade.

Conclusion

We have seen 3 liquidity pools with great returns. Thanks to our strategies and analysis, we have been able to find investment opportunities that not everyone knows about, differentiating us from other traders.

Note that these returns can change from day to day so by the time you do your analysis they may have changed.

These strategies can be applied step by step in the same way for other blockchains and other Decentralized Exchanges, so you can use them from now on to do further research.

This article is for informational and educational purposes only, and should not be taken as investment advice. Do your own research before investing.