TL;DR

- More than $400 billion in institutional capital could flow into Bitcoin before 2026, with $120 billion expected in 2025 alone.

- At least 20 U.S. states and four countries plan to convert seized BTC into strategic reserves or treasury assets.

- Strategy expects to exceed one million BTC held by 2026, and the number of companies adopting similar policies is expected to double.

Institutional capital is increasingly focused on Bitcoin, with projections showing a record inflow of funds over the next two years.

A recent report by UTXO Management and Bitwise Asset Management forecasts that more than $400 billion will enter the Bitcoin market by the end of 2026. Growth won’t be even: over $120 billion is projected to flow in 2025, while 2026 could see that number rise to $300 billion.

4.2 Million BTC in Institutional Hands

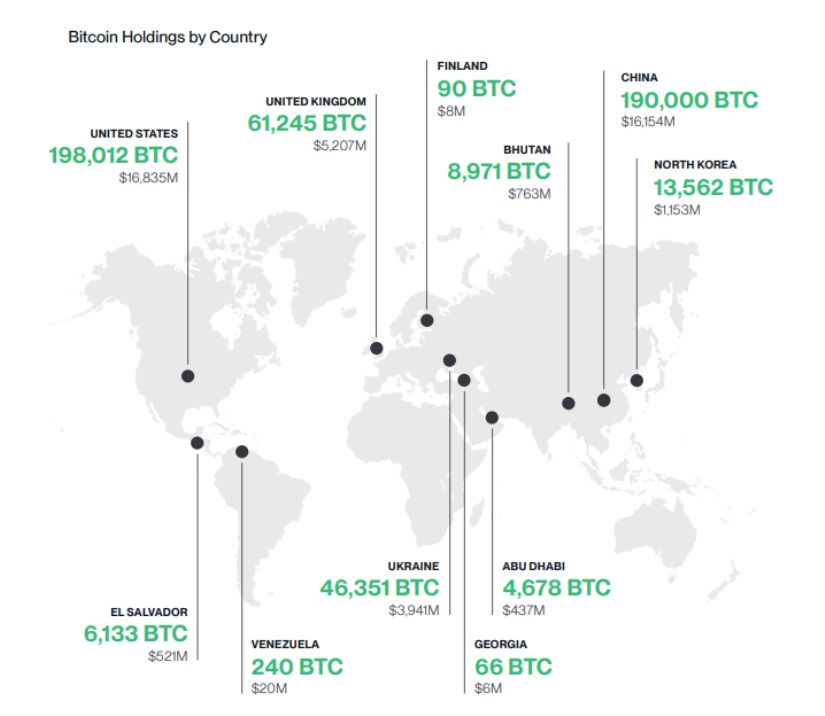

This capital injection could accumulate more than 4.2 million BTC in institutional hands, strengthening their market presence. Much of this trend comes from several U.S. states’ interest in converting seized BTC into treasury assets. More than 20 states, including New Hampshire and Arizona, are considering legislation to formalize these operations. If approved, they could add around $19 billion worth of Bitcoin to their balance sheets.

Additionally, at least five U.S. states and four countries, including Bhutan, plan to establish strategic Bitcoin reserves. Geopolitical volatility and the weakening of fiat currencies make non-sovereign assets more attractive.

Public companies with Bitcoin treasury policies are also expanding their plans. Strategy, already the leader by a wide margin, aims to hold over one million BTC by 2026. The number of firms adopting this approach is expected to double in the same timeframe.

The Bitcoin Market Is About to Change Permanently

To take advantage of this scenario, these companies plan to implement Bitcoin-native yield strategies such as lending and staking to attract new capital and optimize their holdings. Guillaume Girard from UTXO Management explains that this phase of adoption will be defined by decisions based on strong balance sheets and sovereign strategies, moving away from speculative cycles.

Juan Leon from Bitwise Asset Management predicts that BTC will solidify its role as a global store of value over the next 18 months. The convergence of institutional capital, state initiatives, and public companies could structurally transform the BTC market by 202