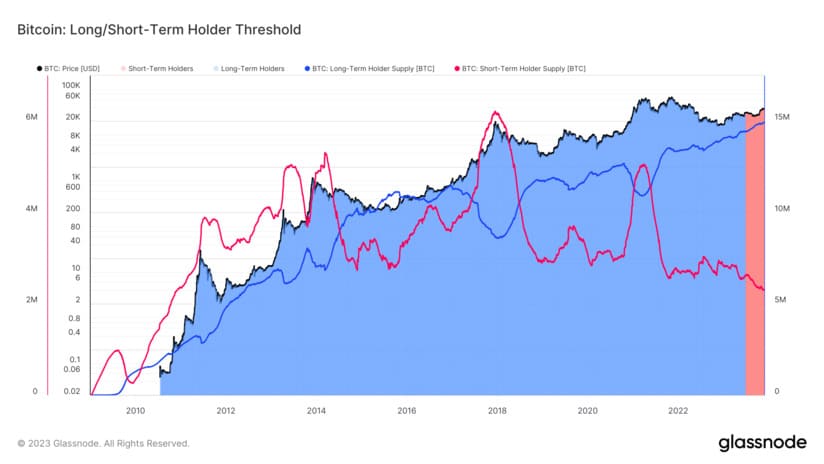

A recent data analysis provided by Glassnode, a significant divergence in the behavior of Bitcoin investors was revealed, especially between those holding the cryptocurrency in the short term (STHs) and those holding it in the long term (LTHs).

The distinction between these two categories is based on a holding period of 155 days, where those who held Bitcoin for more than this time are classified as LTHs, while those with a shorter holding period fall into the STH category.

The most striking aspect of this analysis is the marked difference in the amounts of Bitcoin held by each group. The holdings of LTHs are close to reaching the 15 million bitcoins mark, indicating a sustained accumulation trend over time. On the other hand, STH holdings have significantly decreased, reaching their lowest level since 2010, with only 2.3 million bitcoins in possession. This discrepancy suggests substantial changes in the composition and behavior of investors.

The trend correlates with a specific event that occurred approximately 155 days ago when Bitcoin reached its highest point of the year, reaching $30,000 and maintaining that level for two consecutive months. Since then, short-term investors have experienced a steady decline in their holdings, while long-term investors have continued to accumulate assets.

Investor Trust In Bitcoin

This phenomenon raises interesting questions about the future of BTC. It is crucial to observe whether LTHs continue to increase their holdings or, conversely, experience a decrease. One factor to consider is whether those who bought at the market’s peak, around $30,000, and sold when BTC experienced a dip to $25,000 in August and September, will influence the dynamics of LTHs.

The decrease in STH holdings suggests that short-term investors are decreasing, indicating greater confidence and commitment from long-term investors in the stability and long-term potential of Bitcoin.

At the time of writing this note, according to information provided by CoinMarketCap, BTC has experienced a period of relative stability in the last 24 hours, with only a slight decrease in its value of 0.23%, currently trading at $37,046 per unit. On the other hand, its market capitalization experienced an exactly equal decrease and is $724.44 billion. Its volume grew by approximately 4.85% and exceeds $18.124 billion.