TL;DR

- The Runes protocol, launched alongside Bitcoin’s halving, has experienced a drastic drop in fee share, falling to 8.37% from its debut with $62.55 million in fees.

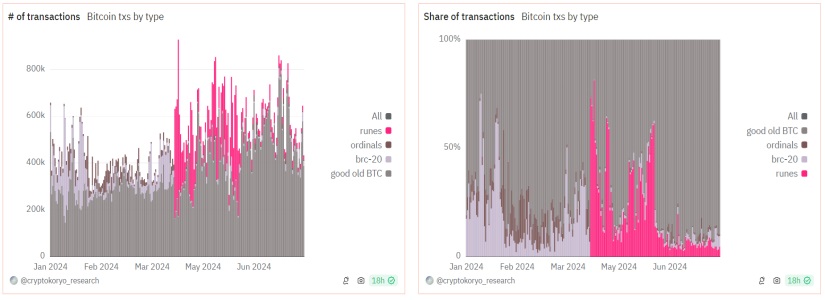

- Although the protocol represents 50% of transactions on Bitcoin, the high activity has not translated into proportional fee revenue.

- The decline of Runes reflects both market conditions and the limitations of Bitcoin’s infrastructure, as well as the challenges of innovating in a conservative environment.

The Runes protocol, launched in April alongside Bitcoin’s halving, has started to show signs of cooling off. Although the protocol’s debut was impressive, generating $62.55 million in fees on its first day, the fee share has sharply declined, falling to 8.37%, a value close to its all-time low of 2.16%. This drop marks a dramatic shift from the initial enthusiasm.

Despite Runes representing approximately 50% of transactions on the Bitcoin network, contributing nearly 10 million of the 19.51 million transactions conducted in July, this level of activity has not translated into proportional fee revenue.

The mismatch between high usage and value capture is notable, especially since over 99% of transactions are dedicated to minting, suggesting a limited usage pattern that has failed to generate liquidity in secondary markets.

Runes Must Deal with Bitcoin’s Rigidity

The decline of Runes can be attributed to both general market conditions and the inherent limitations of Bitcoin’s infrastructure. Deficiencies in Bitcoin’s user experience (UX) have negatively affected the protocol’s volume from the start, highlighting the difficulties of innovating and developing within such a conservative framework.

Runes offers a valuable case study on the challenges of implementing new technologies within Bitcoin’s ecosystem. The protocol faces the harsh reality of maintaining innovation on a network designed for stability. As it struggles to maintain its relevance, its experience will serve as an example of the long-term viability of protocols on Bitcoin’s network and the complex relationship between intensive use and value capture.