TL;DR

- The Federal Reserve is expected to announce a rate cut on December 10.

- Bitcoin rises toward $94,500 ahead of the decision, gaining about 4%.

- Analyst suggests a breakout above $92,000 signals momentum toward $100,000.

The Federal Reserve will announce its final interest-rate decision of the year on December 10, and the crypto market is already assessing the impact. A quarter-point cut appears likely at the end of the two-day Federal Open Market Committee (FOMC) meeting. If delivered, it would mark the third rate reduction of 2025, according to market expectations.

Public remarks from Kevin Hassett, White House economic adviser and the leading candidate to become the next Fed chair, have reinforced those expectations. Speaking at the WSJ CEO Council, Hassett said there is “plenty of room” to cut rates further. He added that, if data supports it, the Fed could continue on that path. His comments arrive as President Donald Trump renews criticism of current chair Jerome Powell, arguing that Powell has been “too late” with rate cuts.

Analysts track rate cuts and the potential move of BTC toward $100,000

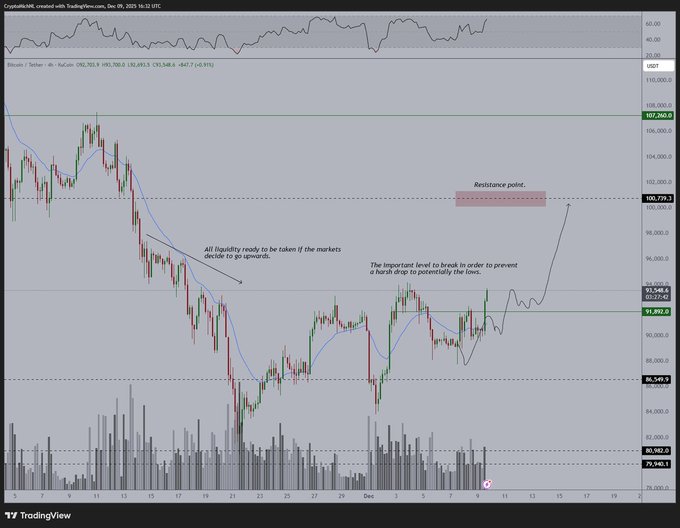

Meanwhile, Bitcoin (BTC) climbed in the session ahead of the decision. The asset gained about 4% on December 9, rising toward $94,500. Analyst Michaël van de Poppe called the move strong and said the market followed a bullish setup. He pointed to a breakout above $92,000 as an early signal of momentum.

Van de Poppe added that he expects BTC to defend the $91,500–$92,000 support area. If that range holds, he sees no reason why BTC cannot test the $100,000 region next. A rate cut could reinforce that path, as lower interest rates often increase available liquidity.

As debate continues, BTC traded near $93,974 at the time of writing. The upcoming Federal Reserve announcement will test the link between monetary policy and digital-asset pricing, a relationship that remains central to each Fed meeting and returns to the spotlight as the year comes to a close.