The crypto market experienced a heightened phase of instability on Monday. This has led to a substantial elimination of long positions, amounting to a notable $130 million. A liquidation takes place when traders speculate on price increases and the market trends in the opposite direction. This involves an automatic selling process to offset their positions.

Over the weekend, Bitcoin’s price was unable to exceed $43,000, and the ensuing decline resulted in a steep drop to a 5-day low of just below $41,000. Concurrently, altcoins are also experiencing a downturn, with SOL falling below $70, and Cardano and Avalanche dropping 7.6% and 10.9% respectively. Memecoins were no exception with Dogecoin losing 7.5%, according to data from CoinMarketCap.

During the last 24 hours, the worldwide market capitalization of cryptocurrencies experienced a decrease of approximately 2%, bringing it to an estimated total of $1.56 trillion.

The Impact of Liquidation on the Crypto Market

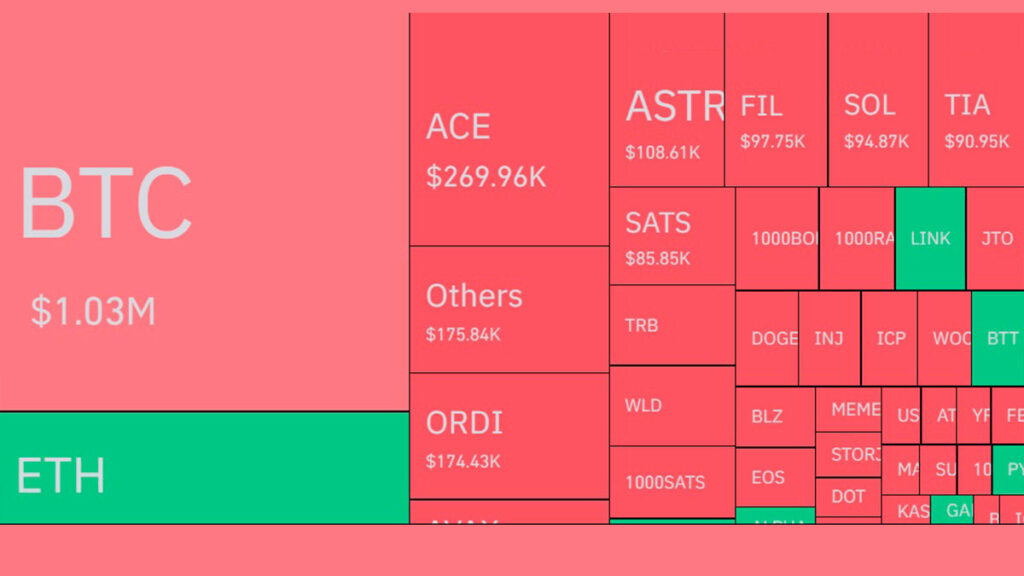

The extent of the effect is evident in the liquidation heatmap, with Bitcoin and Ethereum bearing the brunt of the impact. According to CoinGlass, the Bitcoin graph shows a significant price adjustment for BTC. The fluctuation in Bitcoin’s price frequently influences the broader market, and this instance was consistent with that pattern.

The price decline is closely linked to a series of liquidations, during which numerous leveraged long positions were rapidly wiped out. This indicates that traders, possibly too hopeful of sustained upward momentum, were taken by surprise by the abrupt market shift.

The drop in Bitcoin’s value occurred simultaneously with the announcement that the U.S. SEC had denied a proposal from Coinbase, to amend the regulations about digital currencies. Gary Gensler, the Chair of the SEC, endorsed the Commission’s verdict, underscoring that the current laws and regulations apply to the market for cryptocurrency securities.

He further highlighted the necessity of preserving the Commission’s autonomy in determining its regulatory agenda. The SEC’s role in the cryptocurrency market has been under intense scrutiny, particularly due to anticipations of its approval of the inaugural U.S. Bitcoin spot ETFs in the early part of 2024. Gensler elucidated that the SEC’s decisions are grounded in its legal powers and the judicial interpretation of those powers.