TL;DR

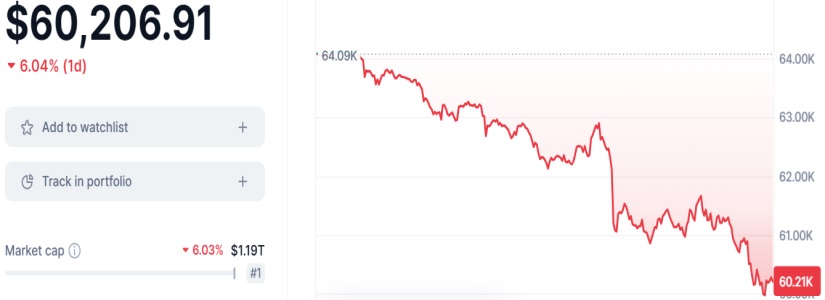

- Bitcoin has dropped more than 5.9% following Mt. Gox’s repayment announcement, falling below $60,300 and dragging the entire market along with it.

- Mt. Gox, once the largest BTC exchange platform, will begin returning 140,000 stolen BTC from 2014, along with 143,000 BCH and $510 million in fiat.

- Investors speculate on the impact of these repayments, expecting approximately 75% of creditors to take their initial payment.

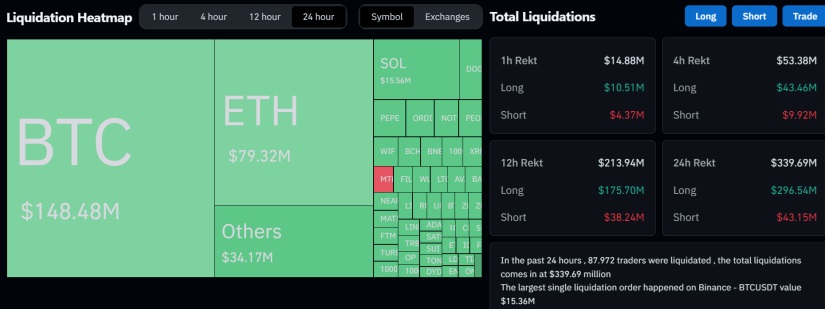

The crypto market endured another day marked by uncertainty. Bitcoin led a significant decline after the announcement that Mt. Gox will start returning over 140,000 BTC to its former users starting in July. This news caused BTC to drop more than 5.9%. In the past 24 hours, a total of 92,311 long positions were liquidated, resulting in accumulated losses amounting to $313 million. BTC has reached its lowest level since early May, falling below $60,300.

Mt. Gox, once the largest BTC exchange platform, suffered a devastating hack in 2014, losing 850,000 BTC belonging to 240,000 users. Since then, affected users have awaited the return of their assets. In September 2023, the trustee announced partial repayments, including 143,000 BCH and a fiat amount, totaling $510 million.

The news of these repayments has sparked alarm and speculation about its impact on the Bitcoin market. Analysts like Alex Thorn from Galaxy Research suggest that while greater selling pressure was expected with the release of these funds, the distributed amount may be less than initially anticipated. Thorn estimates that approximately 75% of creditors will opt to receive their assets in the first round of payments, equivalent to about 95,000 BTC.

The Entire Market Feels the Impact – What Will Happen?

Questions have arisen about how the markets will respond to a significant influx of Bitcoin into the commercial ecosystem. While some investors may be concerned about short-term price impacts, others believe that creditors, many of whom have resisted offers over the years, may hold onto their assets in anticipation of greater future gains, given Bitcoin’s impressive value increase since Mt. Gox’s bankruptcy.

Moreover, this situation coincided with a period of significant outflows from digital investment products, totaling over $1.1 billion in the past two weeks, solidifying a major correction in the crypto market.

According to the latest CoinMarketCap data, Ethereum (ETH) is trading at $3,297 after a 4.92% loss in the last trading day. Cardano (ADA) saw a 4.2% decline, bringing its value to around $0.3701 per unit. Solana (SOL), on the other hand, experienced a milder drop of 2.3% and is trading around $128. BNB (BNB) continues its decline, with a 4.1% decrease and trading just above $559, a drastic loss compared to $720 just 20 days ago.

Regarding meme coins, Dogecoin (DOGE) also lost 4.1% of its value and is currently trading around $0.1166. Meanwhile, Pepe (PEPE) dropped 3.2% and is being traded at approximately $0.00001078.