The crypto market soared today with Bitcoin (BTC) breaching above $23K. Ethereum (ETH) recorded double-digit profits across multiple timeframes with a potential to increase further. Major altcoins witnessed a balmy day as the prices were trading with gains over the last 24 hours. It looks like the surge is in tandem with the hike in the Federal Reserve interest rates in line with market expectations.

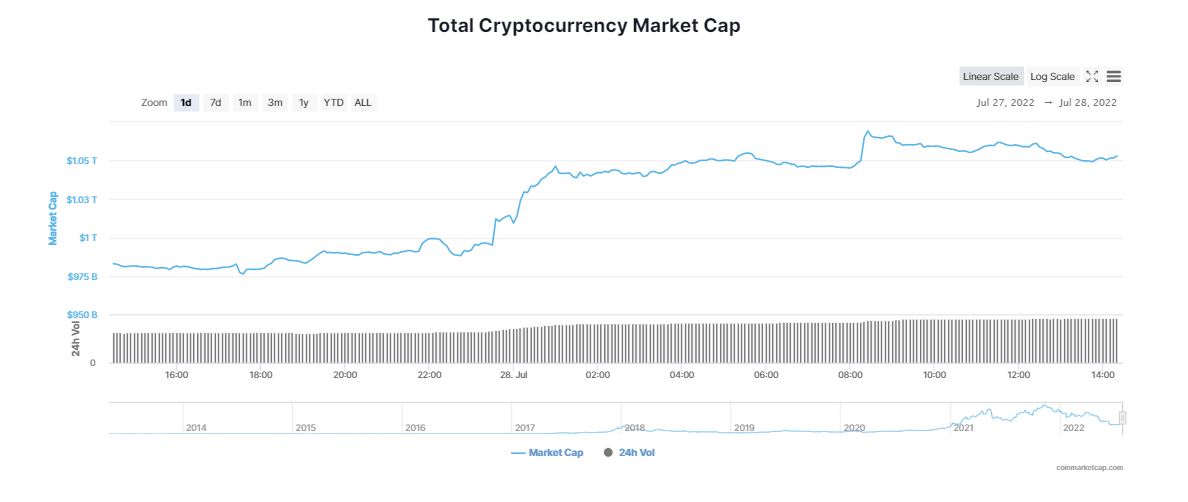

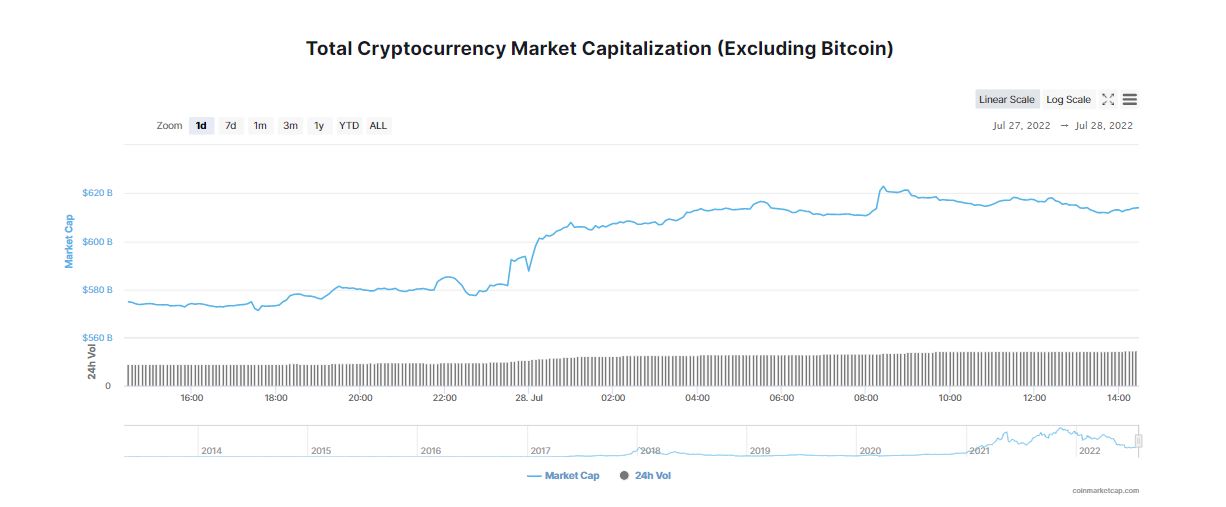

The global cryptocurrency market capitalization noted a sharp rise of over 7.60 per cent in the last 24 hours to reclaim the $1 trillion mark. At the time of writing, the global crypto market cap is at $1.06 trillion. Over the last 24 hours, the total crypto market volume soared by a whopping 49.38 per cent to $92.73 billion. Singapore based, QCP Capital, explained,

1/ Crypto markets have pulled back after showing signs of exhaustion. BTC is trading below 21,000 and ETH below 1,400.

— QCP Capital (@QCPCapital) July 27, 2022

“Every FOMC meeting this year has seen a positive immediate market reaction to the rate decision. We expect the same for this one.”

‘No Recession’ Pushed Positive Market Sentiment

According to CoinMarketCap, Bitcoin (BTC) climbed 7.77 per cent in the last 24 hours to currently hover at $23,055. The bellweather token reported a 0.64 per cent increase over the last 1 week. In the cryptocurrency market, Bitcoin’s dominance also jumped over 0.23 per cent in the last 24 hours to stand at 41.72 per cent. The crypto market seems to have reacted positively after the Federal Open Market Committee (FOMC) meeting which is pushed the interest rate by 75 basis points.

Fed Chair, Jerome Powell’s comments over ‘no recession’ also boosted the market sentiments. However, the recent rate increase has catapulted the central bank’s overnight interest rate from near zero to a level between 2.25 per cent and 2.50 per cent. Powell reiterated,

“I do not think the U.S. is currently in a recession. It doesn’t make sense that the U.S. would be in recession.”

Will ETH See Another Uptrend?

Ethereum (ETH) rocketed more than 11 per cent in the last 24 hours to recapture a price floor of $1,500, which has been in place for the last ten days. ETH is trading at $1,636 at print time gaining nearly 11 per cent over the past 7 days. Experts believe Ethereum (ETH) could be soon set for another uptrend. Edul Patel, CEO of crypto platform. Mudrex, said,

“Ethereum’s long-anticipated software upgrade has made the blockchain’s early offshoot an unexpected winner, pushing up the prices of the latter’s token in recent days.”

Other crypto prices’ today performance also improved in the last 24 hours as Cardano (ADA), XRP and Solana (SOL) recorded gains ranging between 5.32 and 6.75 per cent. In the same time frame, Polkadot (DOT), shot up over 11 per cent to trade at $7.61. Polular memcoins, Dogecoin (DOGE) and Shiba Inu (SHIB) observed a spike of 5.68 and 5.95 per cent respectively.

Expert’s Take on Interest Rate Hike

Market observers believed the markets had already accounted for the Fed’s rate hike, which the bank has been foreshadowing for over a week. According to Edward Moya, a senior market analyst at Oanda, investors are keeping a close eye on Bitcoin (BTC), Ethereum (ETH), and the crypto market at large to see “possible retest of the June lows”. In a statement, Moya, remarked,

“The majority of crypto watchers are still awaiting further weakness. As global recession calls grow, the focus will switch to how soon the Fed will be cutting rates.”

However, Joshua Fernando, crypto expert and CEO of eCarbon, a blockchain tech company focused on carbon emissions allowances, expressed that it is difficult to know whether the market has already priced in this week’s potential rate increase. He added,

“75 basis points appears to be the consensus, so if we see something notably higher and it kills the equity market, then I would expect the crypto market to follow suit. Vice versa in the lower rate increase case. More important will be the guidance the Fed gives. If the Fed signals strong rate hikes through 2023, expect more pain in the markets.”