TL;DR

- Controversial exchange of statements between Tether and Deutsche Bank regarding the solvency of stablecoins.

- The German bank’s report reveals that only 14% of price-fixing systems have survived, questioning the future of stablecoins.

- A survey revealed that only 18% of respondents expect stablecoins to thrive, while 42% expect them to disappear.

There was a controversial exchange of statements between Tether, the world’s largest issuer of stablecoins, and Deutsche Bank, one of the German banking giants. The controversy arises from a report published by Deutsche Bank questioning the solvency of stablecoins, specifically Tether, sparking a debate about their stability and future.

Deutsche Bank’s report, based on a comprehensive study spanning from 1800 to the present day, reveals concerning data about the history of coins with price-fixing systems. According to the analysis, only 14% of these systems have survived over time, raising serious doubts about the long-term viability of stablecoins, which are prone to “turbulence and decoupling.”

"Deutsche Bank's history of fines and penalties raises doubts about its own standing to critique others in the industry. DB was also named the riskiest bank in the world by the International Monetary Fund."

Tether slams Deutsche Bank over suggestion its stablecoin could fail…

— Paolo Ardoino 🍐 (@paoloardoino) May 10, 2024

The report addresses the collapse of TerraUSD, its downfall causing a ripple effect in the cryptocurrency market, highlighting the volatility and risks of the industry. Deutsche Bank also criticizes Tether, pointing out its dominance in the stablecoin market and suggesting that its solvency and crypto derivatives standard could be problematic.

Tether Stands Firm Against the German Bank

For its part, Tether has vehemently rejected the German bank’s claims, arguing that the report lacks clarity and substantial evidence, relying on vague assertions rather than rigorous analysis. The crypto company also defends its solvency and position in the cryptocurrency market, emphasizing its track record and commitment to transparency and security.

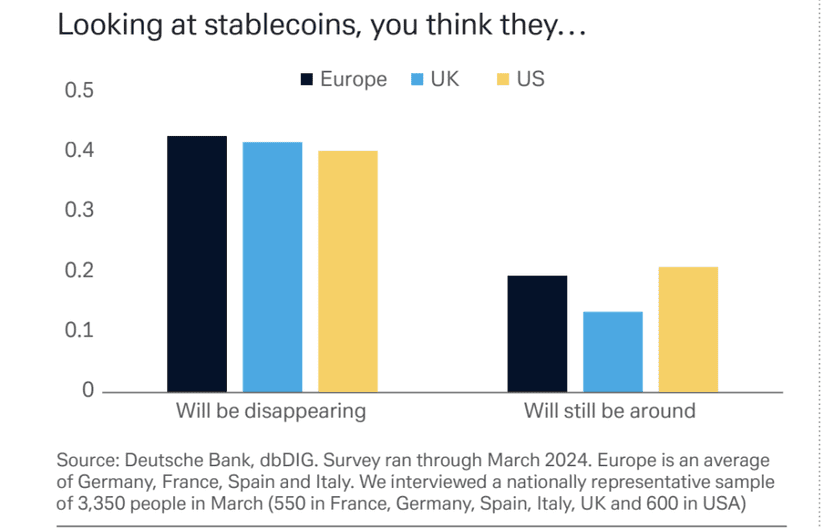

Amidst this discussion, a survey conducted by the bank on over 3,350 consumers in March sheds light on public perceptions about stablecoins. The results show that only 18% of respondents expect stablecoins to thrive, while 42% expect them to disappear.

The dispute between Tether and Deutsche Bank puts the conflict between traditional finance and the crypto market at the forefront as it moves towards widespread adoption. In the immediate future, addressing concerns about transparency, regulation, and stability will be crucial to ensure sustainable growth and increased confidence in the crypto industry.