TL;DR

- Tether has publicly released its investment portfolio for the first time, listing over 120 companies involved in digital infrastructure, AI, blockchain, and hardware.

- The company’s balance sheet is no longer driven solely by USDT: part of its reserves now funds networks, identity systems, and critical technologies.

- Its expansion as an investor underscores its influence in the ecosystem—but also intensifies calls for greater transparency and external oversight.

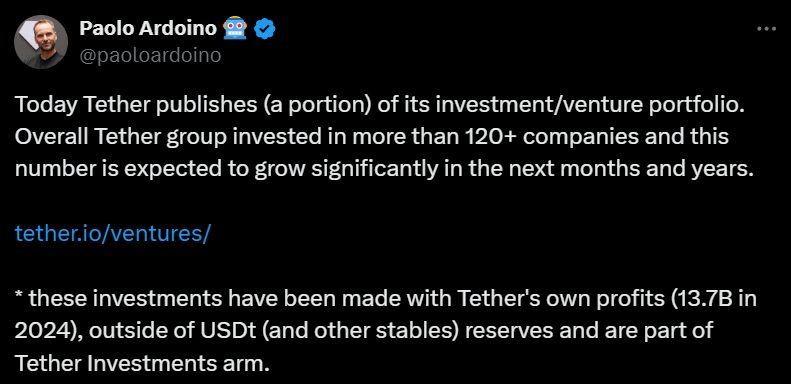

Tether has publicly disclosed its investment portfolio, which now includes more than 120 companies linked to the crypto industry and digital infrastructure.

The announcement, made by CEO Paolo Ardoino, shows that the company is not limited to issuing stablecoins—it also aims to shape the development of key technologies for the sector. The list includes firms focused on blockchain, digital identity, artificial intelligence, satellite connectivity, and hardware development.

Tether remains the undisputed leader in the stablecoin market. USDT, its flagship token, has a market capitalization close to $162 billion. Despite sustained growth, the company continues to face scrutiny over the strength and exact composition of its reserves.

Critics argue that issuing tokens without clear oversight is effectively an unregulated form of money creation. Ardoino rejects that comparison, asserting that every token is backed by liquid assets, mainly U.S. Treasury bonds and other short-term instruments.

Has Tether Taken On a New Role in the Crypto Industry?

In addition to USDT, the company also issues tokens backed by gold and euros, but its balance sheet expansion is not limited to those operations. A portion of its reserves is now used to fund projects that, according to the company, provide structural value to the ecosystem. This strategy is reflected in its involvement in critical infrastructure initiatives such as independent communication networks, decentralized verification systems, and privacy tools.

This new, more active investment approach brings fresh demands for transparency around its decision-making and management of funds. While Tether publishes audited periodic reports, the specifics of each investment and the selection criteria remain opaque. The scale of capital deployment and the concentration of financial power in a single entity are sources of growing tension in the market.

The portfolio disclosure not only confirms the size of Tether’s operations—it also makes clear its ambition to shape the technological direction of the industry