In recent market shockers, Telegram bot tokens have crossed the collective market cap of $95 million. Within the last two weeks, the market cap has doubled. These tokens hail from bots that help users to apply trading strategies through Telegram. They can do so by linking wallets to the bots and also by creating Ethereum (ETH) wallets.

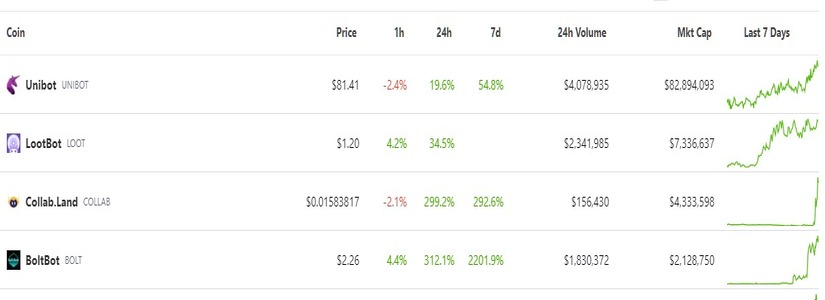

Telegram trading bots have taken the market by storm, attracting traders and investors to invest in them. The most popular token is Unibot with a market cap of almost $83 million, followed by LootBot, Collab.Land, and BoltBot. Through Unibot, traders can automate their trades on the Uniswap Exchange. They are also able to use the snipping feature, allowing them to instantly buy any token right after its listing. Other prominent features include revenue sharing.

According to data from CoinGecko, the value of UniBot has increased by approximately 400% in the past month. Currently, UniBot represents more than 85% of the total market capitalization of Telegram bot tokens. Additionally, the Unibot platform has distributed roughly $1 million in revenue to users who have traded their native tokens. These rewards are equivalent to 40% of transaction fees and 1% of the coin’s trading volume.

These trading bots are the new market sensation, known for built-in wallets that make trading easier for users. The COO of CoinGecko tweeted about the rise of the token category and its increasing relevance in the market.

We are seeing a lot of Telegram bots launching with built-in wallets helping people make degen trades / airdrop farming easier. There are so many bots launching that we created a new Telegram bot category on CoinGecko.

I don't have the time to dive deep into the security aspect… https://t.co/Kp0QFY0VPO

— Bobby Ong (@bobbyong) July 20, 2023

On the other hand, these trading bots also come with multiple risks associated with them. Users are asked to send tokens to third-party wallets. It exposes the data and funds of users to various exploiters. Plus, they can also suffer from rug pulls or potential hacking attempts. Analysts believe that the bot can also store the private keys of users and thus, it can drain the wallets of the users completely.

Despite the risks associated with these bots, many users are willing to take the risk. They believe the ease offered by the bots overshadows its lapses. Users also believe that the bots will improve with time and the only way for them is upwards from here onwards.