TL;DR

- Nearly 50 million Americans own Bitcoin, a figure that far outpaces the number of gold holders, signaling a significant shift in investment strategies.

- Bitcoin’s ease of transfer, digital wallet management, and lower transaction costs make it a preferred alternative over traditional gold storage.

- The asset’s broad appeal, spanning diverse demographics and bolstered by a favorable regulatory framework, marks a pivotal move towards digital wealth preservation.

A new study reveals a striking shift in how Americans allocate their wealth, with Bitcoin increasingly overshadowing gold as the preferred store of value. Recent data shows nearly 50 million Americans now own Bitcoin, significantly more than the roughly 37 million who hold gold. This change highlights an evolving market mindset where digital assets are swiftly emerging as trusted alternatives to traditional safe havens.

Widespread Adoption Across Demographics

The trend of Bitcoin adoption is not confined to a single demographic but spans across diverse age groups, income levels, and political affiliations. With about 14% of the U.S. population holding Bitcoin, the cryptocurrency’s influence now spans far beyond tech enthusiasts and early adopters.

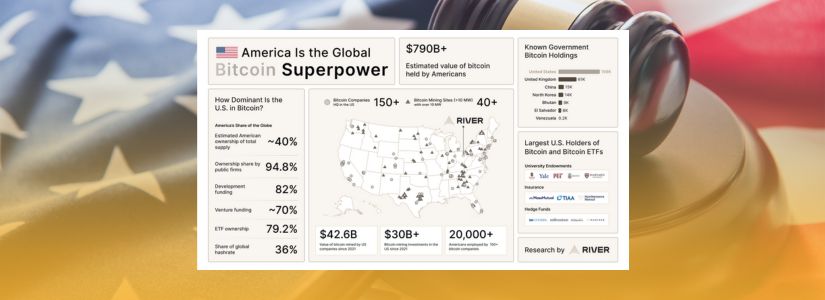

The study points out that Americans, who now account for around 40% of all global Bitcoin holdings, are embracing the digital asset with a fervor that contrasts sharply with their gold investments. While historically, gold has been seen as a secure way to preserve wealth, the emerging digital infrastructure of Bitcoin offers a blend of transparency, security, and accessibility that resonates with a modern audience.

Shifting Store of Value Preferences

Bitcoin’s appeal comes from its ability to transcend the limitations of physical assets. Unlike gold, which requires secure storage and often incurs high transaction costs, Bitcoin allows for immediate transfers and easier management through digital wallets.

This convenience, combined with a growing regulatory framework that is increasingly embracing digital currencies, has spurred investors to reconsider where and how they store their wealth. Moreover, the digital era has simplified the process of acquiring and managing BTC, making it an attractive option for those looking to diversify their financial portfolios without the added hassle of physical custody.

In essence, this study marks a significant moment in financial history. Americans are moving decisively toward a future where digital assets not only coexist with traditional investments but may eventually redefine the landscape of wealth storage. As trust in digital finance continues to build, the long-term implications for both individual investors and the broader economy suggest that BTC’s dominance could herald a new era of investment strategy in the United States.