TL;DR

- Filecoin (FIL) rose 1.8% in 24 hours, showing atypical strength against the CoinDesk 20 decline.

- The rise occurred with above-average volume, driven by capital rotation into infrastructure assets.

- Key trading levels are set between support at $1.61 and resistance at $1.65-$1.67.

While most of the digital asset ecosystem was registering losses, Filecoin, the decentralized storage token, stood out with a 1.8% gain in the last 24 hours, trading at $1.62. This price movement demonstrates remarkable relative strength, with Filecoin defying the general crypto market weakness, evidenced by a 1% drop in the broad indicator.

Filecoin’s advance was not an isolated event; the token was backed by high transaction volume. According to makert data technical analysis model, this behavior is consistent with a rotation of capital by traders towards blockchain infrastructure projects.

FIL’s superior performance suggests focused interest in the sector’s fundamentals, even when risk aversion dominates overall market sentiment. During the session, the storage token experienced a total volatility of 7.5%, moving within a trading range of $0.13.

Technical Analysis: Key Levels to Watch in FIL

Technical model data shows that FIL found a solid buyer base near the primary support level of $1.61, which pushed the price upwards. However, the momentum met a selling wall in the critical resistance zone located between $1.65 and $1.67. It is important to note that this same zone had already halted a previous rally that sought to reach $1.74, a level that remains a short-term challenge.

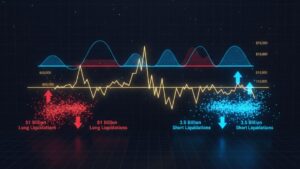

Regarding trading activity, FIL’s daily volume increased by 21% above its weekly average, remaining within normal consolidation parameters. However, analysts recall that a massive peak of 18.07 million (190% above the simple moving average) on November 25 marked a failed bullish breakout attempt. Since then, a descending channel with decreasing volume has developed, confirming a consolidation phase.

While institutional liquidation temporarily created a support breakdown pattern, FIL’s current strength holds. The tightest immediate resistance level is between $1.614 and $1.617, offering an opportunity for re-evaluation towards $1.65.

On the downside, if the $1.61 support fails to hold against an expansion of selling volume, the downside target is projected towards $1.60. Filecoin’s resilience, while market breadth struggles, highlights the narrative that fundamental value continues to attract capital in specific niches, confirming that Filecoin successfully defies market weakness for now.