TL;DR

- Stablecoins are projected to reach a transaction volume of $5.3 trillion in 2024, having settled $3.7 trillion in 2023.

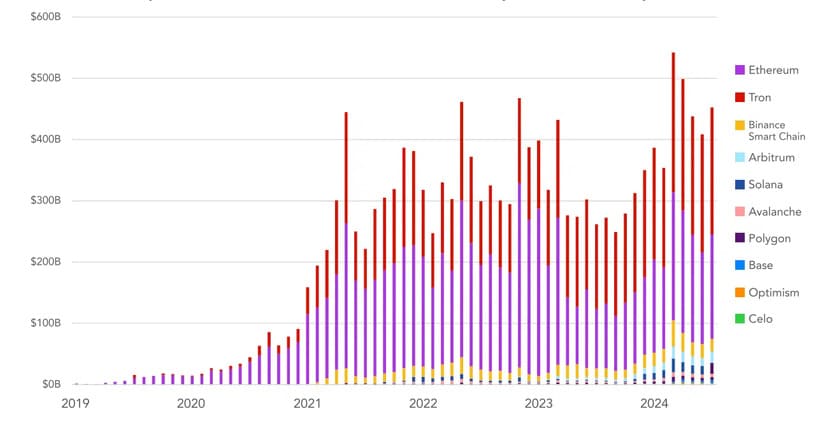

- Research conducted by Visa and Castle Island Ventures shows that Ethereum, TRON, and other blockchains are the most used for their settlement.

- 47% of respondents use them for saving, 43% to improve currency conversion, and 39% to earn yields.

Stablecoins are on track to reach a transaction volume of $5.3 trillion in 2024, despite the challenges faced by the market. According to recent research, they settled $3.7 trillion in 2023 and are experiencing continuous growth in their use, which extends beyond exchange transactions.

The research, sponsored by Visa and conducted by Castle Island Ventures and Brevan Howard Digital, reveals that stablecoins are gaining significant importance in the global financial system.

In the first half of 2024, a value of $2.62 trillion in stablecoins was established, suggesting that the sector is heading towards an annualized volume of $5.28 trillion. This trend appears to be solidifying despite the overall decline in the cryptocurrency market and the decrease in trading volumes observed over the past two years. Data shows that stablecoin transactions have grown steadily, with adoption going well beyond mere cryptocurrency trading.

According to the report, Ethereum, TRON, Arbitrum, Coinbase’s Base, BNB Chain, and Solana are the most popular blockchains for stablecoin settlements, with Ethereum leading the way.

Stablecoins as a Preferred Savings Mechanism

The importance of emerging markets such as Nigeria, Indonesia, Turkey, Brazil, and India is also highlighted, where the use of stablecoins for non-trading purposes is increasing. Among the main uses are saving in dollar-denominated assets, improving currency conversion rates, and earning yields. Approximately 47% of respondents use them for saving, 43% for better currency conversion, and 39% for earning yields.

On the other hand, 57% of users reported an increase in stablecoin usage over the past year, and 72% expect this trend to continue. Despite the popularity of Tether (USDT) as the most used stablecoin, Ethereum has been the preferred blockchain for value exchange. The evolution in its use represents a shift from its original function as trading collateral to a general-purpose digital instrument in the studied regions.