TL;DR

- Expectations for the upcoming launch of Ethereum ETFs in the U.S. prompt evaluation of the impact on ETH price volatility.

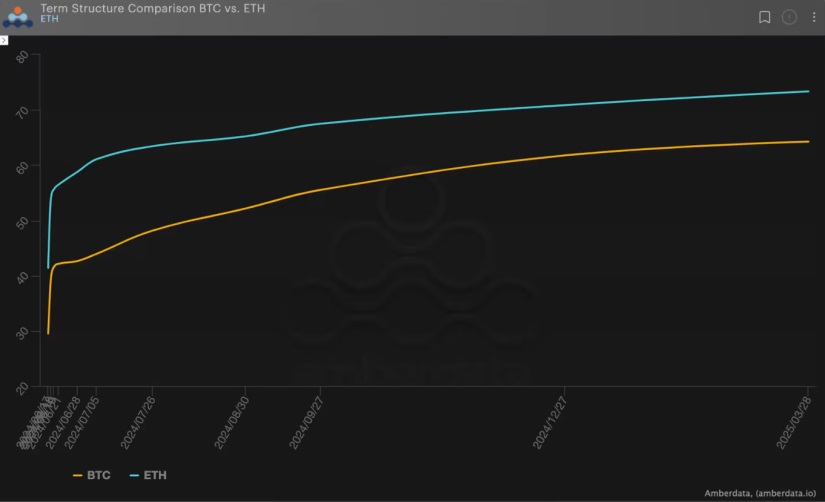

- ETH implied volatility has consistently surpassed that of BTC, marking a differential of 17% according to Amberdata.

- Doubts persist regarding whether capital flows into ETH ETFs will reach levels seen with BTC ETFs.

Amid expectations for the imminent launch of Ethereum exchange-traded funds (ETFs) in the United States, investors and market analysts are assessing the impact on ETH price volatility. According to a recent analysis, the discrepancy in volatility expectations between ETH and BTC has significantly widened. In other words, there is enthusiasm surrounding the introduction of ETH ETFs.

The implied volatility index for Ethereum has consistently outpaced Bitcoin’s in recent months, registering a 17% differential according to Amberdata. This disparity suggests that investors anticipate greater price fluctuations in ETH compared to BTC, attributed to the arrival of ETH ETFs in the U.S. market.

Greg Magadini, derivatives director at Amberdata, expressed skepticism about the sustainability of this relative volatility premium. Magadini argues that, similar to Bitcoin ETFs, investors may primarily utilize Ethereum ETFs for non-directional arbitrage strategies such as basis trading. This approach involves exploiting price differences between spot and futures markets for profit, rather than taking outright bullish positions in ETH.

Expecting Increased Price Movements for Ethereum Across All Time Frames

The temporal structure of implied volatility also highlights a widespread expectation of higher price movements for Ethereum across all time frames compared to Bitcoin. However, there exists a significant disparity in futures open interest, with Bitcoin futures at the Chicago Mercantile Exchange significantly surpassing those of ETH. This indicates lower institutional acceptance and trading volume for the latter compared to Bitcoin.

Despite these expectations, doubts persist about whether capital flows into ETH ETFs will match those seen with BTC ETFs. JPMorgan has suggested that Ethereum ETFs could attract approximately $3 billion in net inflows this year, well below the $15 billion directed towards Bitcoin ETFs since their inception.