TL;DR

- Solstice’s USX experienced a temporary de-peg driven by heavy selling pressure and low liquidity, reigniting concerns about stablecoin stability on Solana.

- The protocol injected liquidity after nearly three hours of tension, released a reserves attestation, and said $USX remains backed and redeemable 1:1 for USD.

- TVL fell just 2.15%, but the episode coincided with a weak $SLX ICO that raised $633,000, only 15.85% of the target.

Solstice’s $USX stablecoin suffered a temporary de-peg that put the Solana ecosystem on alert and once again exposed the fragility of parity mechanisms when liquidity drops to critical levels.

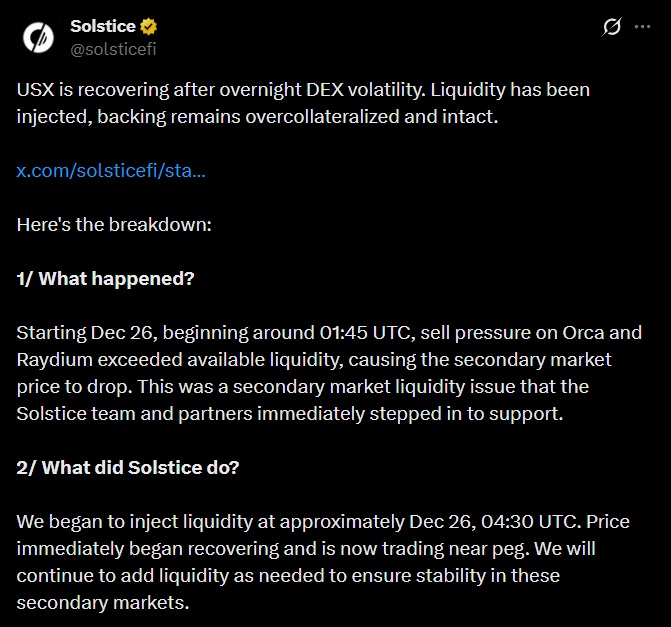

On December 26, around 01:45 UTC, heavy selling pressure in secondary markets pushed the token down to a low of $0.78, during a time window marked by reduced activity due to the holiday period.

The Solstice Team Acted Quickly

For nearly three hours, the market operated amid uncertainty. Around 04:30 UTC, the Solstice team began injecting liquidity into $USX trading pairs to stabilize the price and bring it back toward the dollar range. Throughout the episode, the company’s co-founder and CEO said the stablecoin remained fully backed, overcollateralized, and redeemable at a 1:1 rate for USD.

In addition, the protocol released a reserves attestation prepared by Accountable to demonstrate solvency and address doubts about the stablecoin’s backing. At the time of writing, $USX is trading near $0.9987, indicating that the peg has been largely restored following the intervention.

Even so, the de-peg left several open questions. Many users called for more active peg management and deeper liquidity to prevent future deviations. Another point of friction was the lack of clarity around redemption mechanisms. In a subsequent report, Solstice reiterated that redemptions are a permissioned process, available only to institutional partners that have completed KYC, a framework many retail users were unaware of.

The Impact of the De-Peg Was Minimal

The impact on the protocol was limited in terms of locked capital. Solstice’s TVL fell by about 2.15% after the de-peg, a moderate decline for a project that had surpassed $300 million in just a few months. This suggests that a significant portion of depositors trusted the team’s response, although it is also possible that the market has not yet fully digested the event.

At the same time, Solstice had already been dealing with another sensitive issue. Days earlier, the $SLX token ICO, hosted on the Legion platform, raised just $633,000, roughly 15.85% of the target. Market observers attributed the weak demand to poor timing, as the sale coincided with Christmas week and reduced speculative activity