TL;DR

- Solana proposes doubling its annual disinflation rate to 30% with SIMD-0411, cutting projected emissions by 22 million SOL and strengthening the network’s monetary base.

- DeFi Development Corp. supports the proposal, contributing $300M in SOL and adding institutional weight to the discussion.

- The measure aims to position SOL as an institutional-grade asset, activate a deeper and more predictable market, and align monetary policy with the network’s maturity.

Solana faces a critical point in its monetary policy after a 30% drop in SOL’s price over the past month, from $197 to $136.

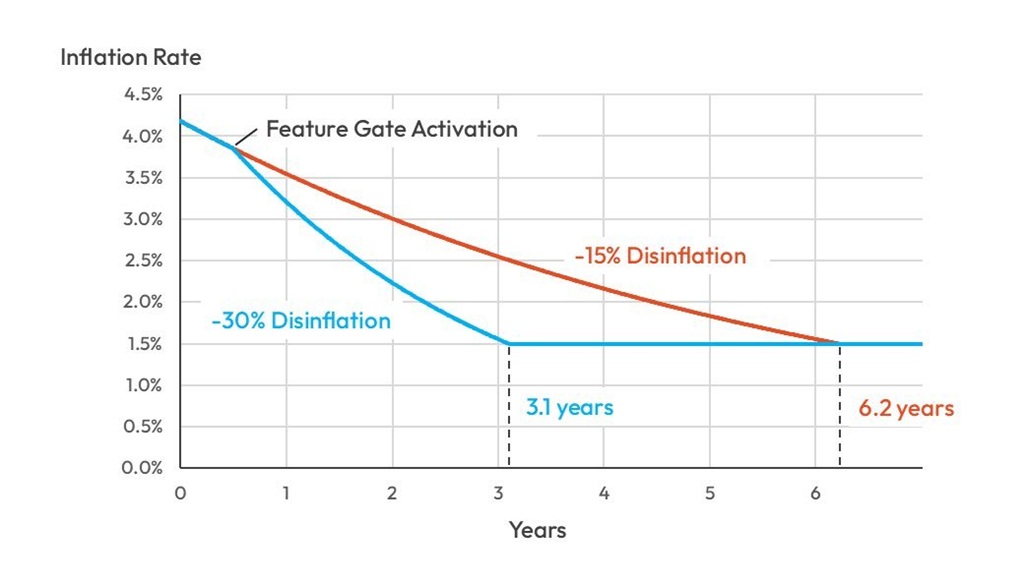

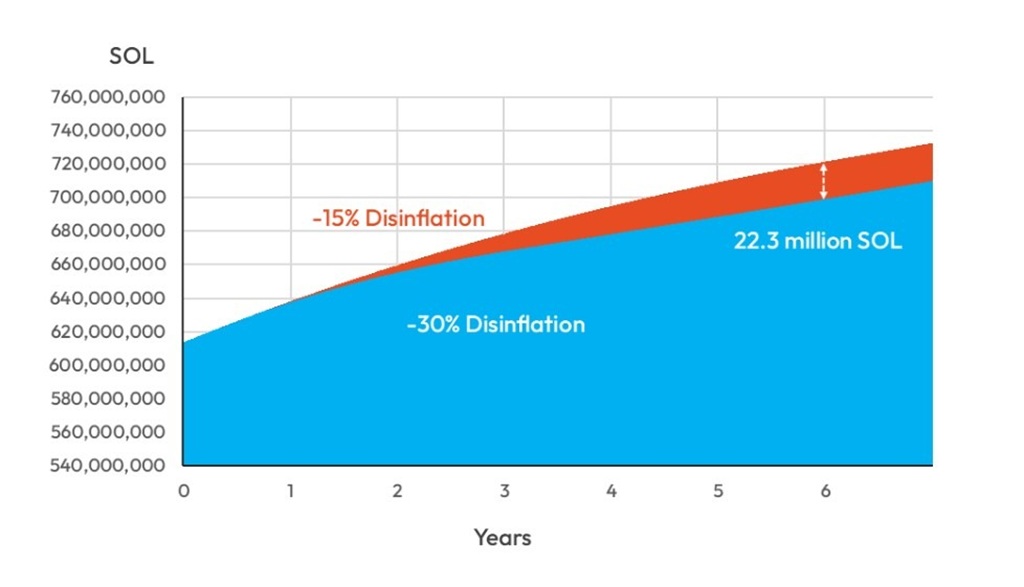

The network is moving toward a restructuring of its inflation with the SIMD-0411 proposal, which seeks to double the annual disinflation rate from 15% to 30%, bringing Solana to its 1.5% terminal inflation rate in three years instead of six. The change would reduce projected emissions by over 22 million SOL, roughly $3 billion, strengthening the monetary base and easing structural sell pressure on the token.

Solana-Based Treasuries Join the Discussion

DeFi Development Corp. (DFDV) became the first Solana Digital Asset Treasury (DAT) to publicly endorse SIMD-0411. With nearly 2.2 million SOL under its control, valued at $300 million, DFDV brings institutional weight to the debate. Other major corporate holders, such as Forward Industries and Solana Company, have not yet expressed a position, although the pressure from unrealized losses is evident: Forward Industries holds $646.6 million in losses and Upexi $31 million, while DFDV maintains an unrealized gain of $62 million.

Support for SIMD-0411 reflects Solana’s maturity. The network has outperformed Ethereum on key metrics: protocol revenue reached $1.42B in 2024 and $1.38B so far in 2025; DEX volume grew to $1.45T this year; and new wallets totaled 948 million in 2025 alone. Solana has moved past its bootstrapping phase and seeks to reflect this growth in its monetary policy.

Aiming for a Deeper and More Active Market

The proposal introduces a simple, predictable adjustment: a single parameter, unchanged terminal inflation, and a six-month grace period for validators, delegators, and staking products to adapt their models. This will reinforce SOL’s monetary properties, making the token attractive for institutional allocators and ETFs, while fostering a deeper, more efficient, and active DeFi market. It also encourages validators to generate real value instead of relying on inflation.

Risks include compressed staking yields, lower validator participation, and temporary market volatility. However, the benefits outweigh these costs, as SIMD-0411 aligns monetary policy with Solana’s growth, reduces sell pressure, and lays a solid foundation for the next decade of adoption.