TL;DR

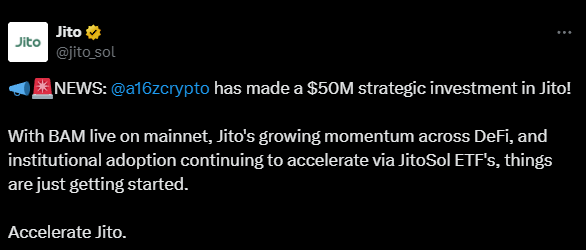

- Andreessen Horowitz invested $50 million in Jito, a liquid staking protocol essential to Solana, through its a16z crypto division.

- The deal includes a lock-up period preventing a16z from selling the acquired tokens and aims to align long-term incentives between the fund and the protocol.

- Jito allows Solana validators to gain liquidity from their staked tokens and improves transaction processing efficiency across the network.

Andreessen Horowitz invested $50 million in Jito, a liquid staking protocol that plays a key role within the Solana blockchain.

The investment was made through its dedicated crypto division, a16z crypto, and represents one of the fund’s largest commitments to infrastructure tied to the Solana ecosystem. In return, the firm received an allocation of Jito’s native tokens, according to Brian Smith, executive director of the Jito Foundation, the entity responsible for the protocol’s development.

Aligning Objectives

Smith explained that the deal aims to align long-term incentives between the fund and the protocol, and includes a lock-up period during which a16z will not be able to sell the acquired tokens. He also said the amount marks the largest single investment Jito has ever received. Although he declined to disclose the specific discount terms, he acknowledged that such restrictions typically come with a price adjustment favoring the buyer.

Direct token purchases, rather than equity stakes, have become increasingly common among funds investing in crypto assets. Andreessen Horowitz has executed several such deals in recent months, including a $55 million token purchase from LayerZero in April and a $70 million deal for EigenLayer tokens in June.

Jito: A Core Component of Solana

Jito occupies a central role in Solana’s infrastructure, one of the most widely used blockchains on the market. Its protocol enables liquid staking—a mechanism that provides liquidity to validators who must lock up large amounts of tokens to operate within the network. Instead of keeping their assets immobilized, validators can use or trade liquid representations of those tokens in other applications without forfeiting their staking rewards.

In addition, the protocol includes tools that allow developers to prioritize how their transactions are processed within Solana, improving overall network efficiency. Smith emphasized that Jito’s growth is directly tied to Solana’s development and to the continued expansion of its technical infrastructure