TL;DR

- Solana ETF products recorded $10.67 million in net inflows, aligning SOL with a broader rebound across major crypto investment vehicles.

- SOL trades near a critical technical zone, with $159 identified as the next major resistance.

- Market data shows stable participation and modest price gains, reinforcing Solana’s position as one of the most closely watched assets during the current phase of institutional reallocation.

Solana has returned to focus as exchange-traded fund activity improves across the digital asset market. After a stretch dominated by redemptions, fresh capital has flowed back into crypto-linked products, suggesting a cautious adjustment in investor positioning. Within this environment, Solana ETF inflows and tightening price action placed SOL near a technical inflection point closely monitored by traders.

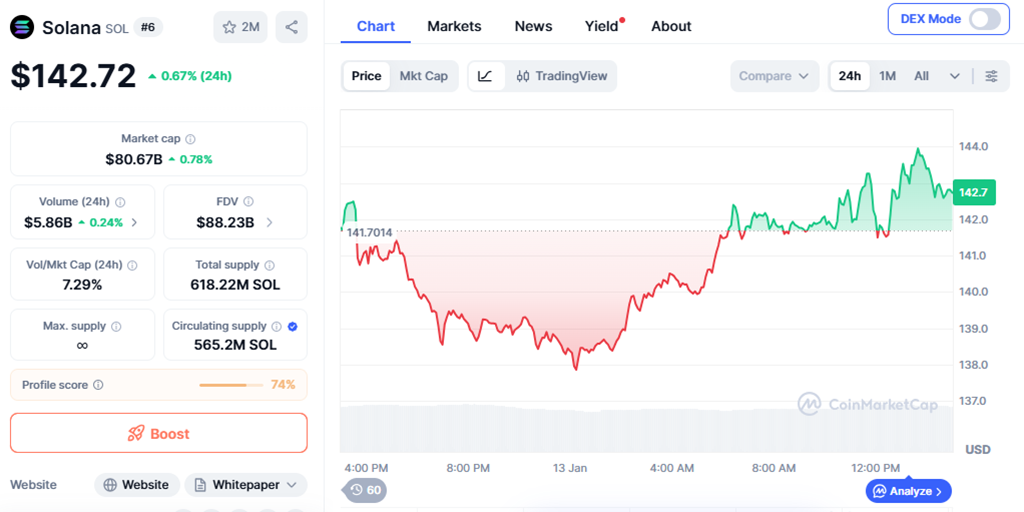

At the time of writing, SOL trades at $142.72, posting a 0.67% gain over the past 24 hours. Price action remains compressed within a defined range, while volume trends point to continued engagement rather than short-lived momentum trades.

Solana ETF Inflows Reflect Selective Institutional Interest

Solana ETF inflows reached $10.67 million, joining a broader return of capital into spot crypto products. Bitcoin ETFs led the rebound with $117 million in net inflows, while Ethereum products added $5.04 million. XRP-linked vehicles also recorded $15.04 million, indicating that demand extended beyond a single asset class.

The pattern of inflows suggests selective positioning instead of aggressive risk expansion. Institutional participants appear focused on assets offering liquidity, network activity, and relative strength. Solana’s presence among the leading inflow recipients reinforced its role as a core exposure within diversified crypto strategies.

Supporting this view, SOL maintained daily trading volume near $6.6 billion. With a circulating supply close to 570 million tokens, market depth has remained sufficient to absorb steady inflows without triggering abrupt price dislocations. These conditions continue to attract both systematic and discretionary participants.

Technical Structure Tightens As SOL Approaches Resistance

From a technical standpoint, attention remains fixed on the $159 level as a key resistance zone. Analysts noted that SOL continues to hold above the $138 area, which has functioned as short-term support during recent consolidations.

Ali Martinez observed that reclaiming the $144.63 level would improve short-term structure and raise the probability of a move toward $159.10. Until that level is secured, momentum remains unresolved. Other analysts pointed to potential divergence signals on higher time frames, highlighting the importance of confirmation before any sustained advance.

Solana $SOL turns bullish above $144.63. A breakout there opens the door to $159.10. pic.twitter.com/CFIXPuWoXQ

— Ali Charts (@alicharts) January 13, 2026

Relative performance has also played a role. Periods of weakness in other large-cap assets encouraged rotation toward SOL, helping it maintain stability near range highs despite broader uncertainty.