TL;DR

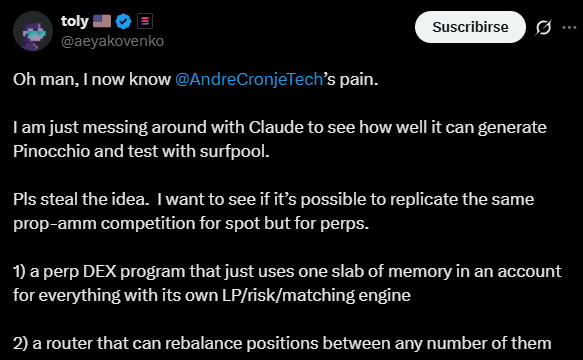

- Solana’s co-founder has clarified that the “Percolator” code on GitHub was an AI test project, not an official initiative.

- The experimental design included its own liquidity engine, a router for rebalancing positions, and perpetual contracts.

- SOL is trading above $197 and testing its historical support at $185; a rebound could take it to $220–$260, while losing that level could open declines toward $165–$150.

Solana drew widespread attention after the publication of experimental code simulating a perpetual futures DEX. Anatoly Yakovenko, the network’s co-founder, uploaded a repository called “Percolator” to GitHub, which initially sparked speculation that Solana might compete with DEXs like Hyperliquid and Aster.

However, Yakovenko clarified that it was an AI test project and not an official initiative. The post still encouraged developers to explore and build similar concepts.

The experimental design featured a single-memory perpetual DEX with its own liquidity and matching engine, as well as a router capable of rebalancing positions across multiple accounts. These types of contracts allow traders to speculate on asset prices without holding the underlying tokens, and they have become one of the most active sectors in DeFi. Platforms like Hyperliquid and Aster dominate the market, offering extreme leverage up to 1,001x on Bitcoin, highlighting strong demand for high-risk, high-reward trading strategies.

Currently, Solana hosts several perpetual DEXs, but none have reached the liquidity or scale of the top competitors. The appearance of Yakovenko’s code sparked expectations about Solana’s ability to develop more efficient on-chain trading engines capable of handling large-scale perpetual contracts and competing with other blockchains in derivatives.

Solana Community Recognizes the Initiative

The community acknowledged the initiative, noting that experimentation led by the founders keeps the ecosystem highly dynamic and encourages the development of applications that leverage Solana’s speed and low transaction costs.

In market terms, SOL is trading above $197, up 4.1% over the past 24 hours. The token is testing its long-standing ascending trendline around $185, which has acted as strong support. If it holds, SOL could move toward $220, with a potential advance to $260. Conversely, breaking support below $180 could trigger declines to $165 or $150.

Although clarified as an AI test, the publication of this code demonstrates Solana’s potential to drive the development of disruptive products, explore new trading architectures, and create innovative tools for the community