Recent crypto headlines have focused on Solana (SOL) and Ripple (XRP) as ETF net-flow figures shift between products. Separately, Digitap ($TAP) says it is developing an “omni-bank” ecosystem.

Digitap describes itself as being in an early-stage token sale and says it aims to make crypto usable for payments. According to the project’s materials, its ecosystem is intended to connect parts of traditional finance with blockchain infrastructure.

The ETF discussion around SOL and XRP is separate from Digitap’s development. Any statements about longer-term outcomes (including references to 2026) are inherently uncertain and should not be treated as forecasts.

Net outflows recorded for Solana ETFs

Solana drew significant attention around its ETF launch and early trading volumes. More recent flows have been mixed.

On December 3, Solana ETFs recorded a $32.19 million outflow, according to the linked data source. The move came while broader market conditions appeared to be stabilizing, suggesting that some holders may have reduced exposure despite improving sentiment.

The outflow was attributed in the article’s figures to the 21Shares TSOL ETF, which was reported as losing $41.79 million in one session, partially offset by smaller inflows elsewhere.

TSOL is described here as accounting for several of the larger negative flow days for Solana ETF products, including a $13.55 million outflow on December 1 and an $8.10 million outflow in late November. Cumulatively, TSOL is described as being down over $101.51 million since launch, based on the figures cited in this article.

Solana ETF flows are mixed

Not all Solana ETF products are shown as recording outflows. The Bitwise Solana ETF (BSOL) is described as having recorded over $580.72 million in cumulative inflows, while Grayscale’s GSOL is described as contributing $623.21 million in inflows.

Even with these figures, this article’s comparison suggests Solana trails XRP on cumulative inflows across the products referenced, and the continued TSOL outflows may indicate rebalancing in parts of the market.

ETF flow data can change quickly and does not, on its own, establish long-term performance for any token or product. Digitap, by contrast, is not an ETF product and should be evaluated separately as an early-stage project.

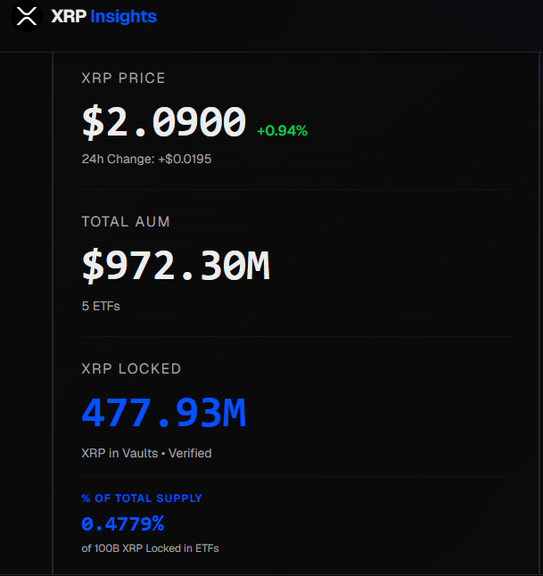

XRP ETF assets approach $1B in the cited figures

This article describes XRP ETFs as recording consistent inflows since launching in November and approaching $1 billion in cumulative assets.

According to xrp-insights.com, five spot XRP ETFs hold over $972 million in assets, as cited here. The article also notes 15 straight days of inflows, based on the same set of figures.

Although XRP is described as having fewer ETF products than Solana, it is shown here with higher net momentum in the cited numbers. The article attributes some of XRP’s institutional appeal to its cross-border payments narrative; views on adoption and long-term demand can differ across market participants.

Solana is described as launching seven ETF products in late October, while XRP launched four in November. Based on the figures cited in this article, XRP’s cumulative inflows are described as higher over the period referenced.

Digitap ($TAP): project overview

The ETF flow discussion indicates where demand for certain exchange-traded products is concentrated in the short term. Digitap is presented as a separate, early-stage project and should not be directly compared to large-cap tokens solely on narrative or marketing claims.

Digitap describes what it calls an omni-bank ecosystem that blends elements such as virtual cards, payments, banking-as-a-service, and crypto-related debit functionality.

The project says its aim is to make crypto usable in everyday transactions. Supporters frame this as a focus on consumer-facing tools rather than operating a base-layer network or an ETF product.

As with other early-stage token sales, the risks can be materially different from those associated with more established assets, and outcomes are uncertain.

Digitap highlights payment-focused features

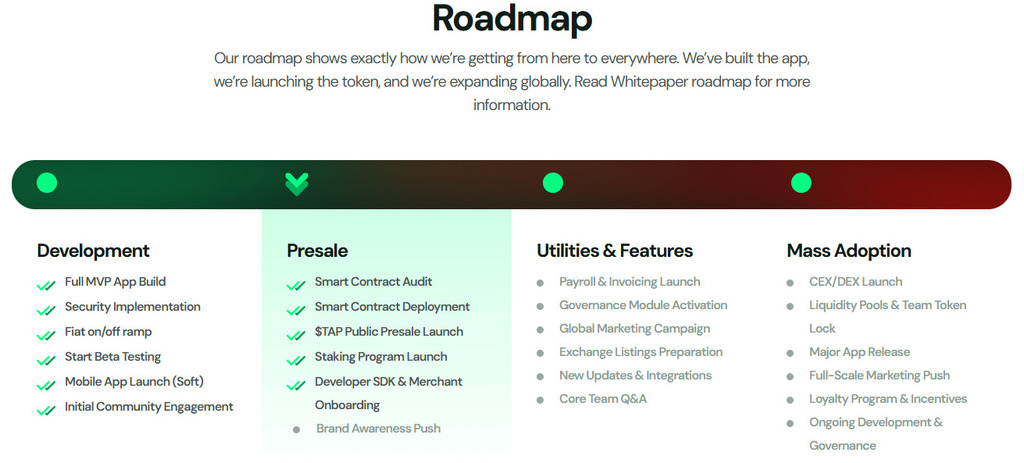

Digitap’s token sale is accompanied by a roadmap described on its site. The project positions itself around payments and digital-banking features rather than short-term price narratives.

Project materials reference card-network integration (including Visa) and a focus on making crypto usable through bank-like services. These claims are based on information provided by the project and are not independently verified in this article.

The project also says users would be able to access virtual cards, manage digital assets, execute payments, and interact with on-chain finance through its tools, subject to product delivery and regulatory constraints.

Any suggestion that ETF flow trends necessarily translate into better outcomes for unrelated early-stage tokens should be treated with caution.

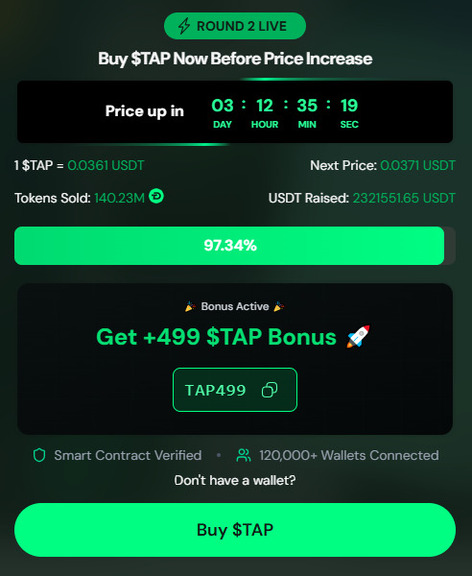

Digitap reports $2.3M raised in early funding

Digitap says it has raised over $2.3 million in early funding. This figure is project-reported and is not independently verified in this article.

The project lists the $TAP token price at $0.0361 during its token sale and states that more than 140 million $TAP tokens have been sold. It also cites a prior “launch value” of $0.14; these claims are presented here for context and are not a guarantee of future pricing.

ETF flow trends and early-stage projects are not directly comparable

Solana’s outflow days and XRP’s reported inflows illustrate how quickly ETF demand can change. These figures reflect activity in specific financial products and do not necessarily translate into broader adoption, price performance, or fundamentals for the underlying tokens.

Digitap is positioned by its team as a payments and banking-focused build. Whether it can deliver its roadmap, secure partnerships, and reach users remains uncertain and depends on execution and broader market and regulatory conditions.

Project links (for reference):

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article contains information about an early-stage token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.