Crypto market participants often weigh established networks against newer projects that may carry higher uncertainty. Solana (SOL), for example, has seen significant price volatility over the past few years, rising from around $50 in late 2023 to peak at nearly $300 in early 2025.

Solana is up about 10% over the past year, based on the figures cited here. In contrast, Digitap ($TAP) is an early-stage fintech and crypto project that is conducting a token sale, which carries materially different risks and information availability than trading a large, established asset.

Source: Digitap

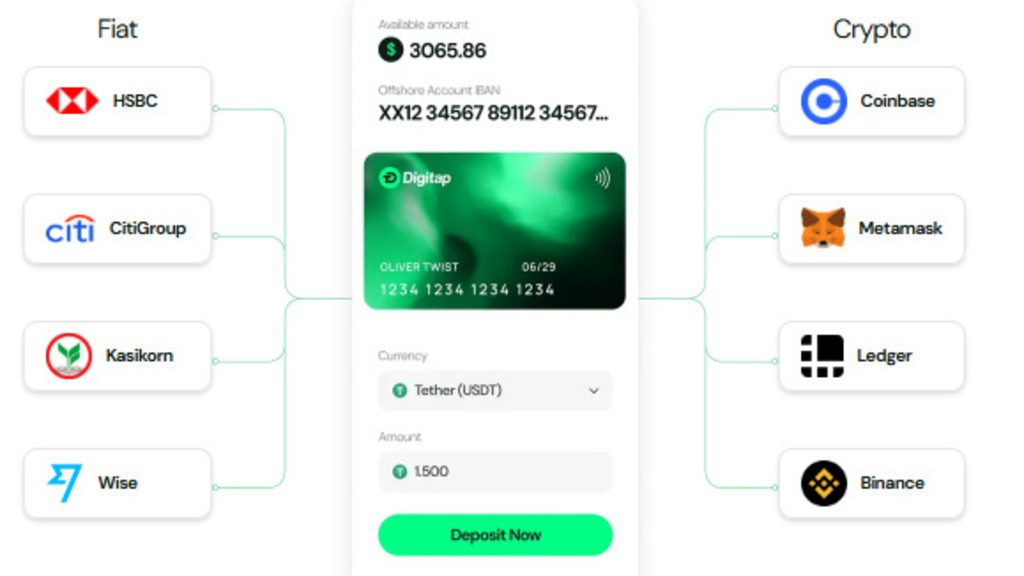

Digitap’s App Blends Fiat And Crypto With Visa Tap To Pay

Digitap is described by the project as a fintech and crypto product with a banking app available on iOS and Android devices. According to its materials, users can hold fiat currencies and cryptocurrencies in one app, transfer funds internationally, and spend through a Visa-branded card where available.

The project also says it offers an account option with reduced identity verification requirements for access to certain features. Verification, feature availability, and eligibility can vary by jurisdiction and compliance requirements.

Digitap says it aims to compete on fees for transfers between users. The project claims some transfers can be priced below 1%, compared with industry estimates that often place average remittance fees at around 6.2% (the specific sources and methodology are not provided in this article).

What a speculative valuation model looks at: users, valuation, supply

Digitap’s token sale materials list a token price and staged rounds that may change over time. Any implied gains based on earlier token-sale pricing are not realized outcomes and may not reflect future trading prices or liquidity, if a market develops.

Some market commentary around Digitap has cited hypothetical valuation scenarios based on user growth and comparisons to larger, publicly traded crypto and fintech companies. These comparisons rely on multiple assumptions (including user acquisition, revenue per user, regulatory outcomes, and token economics) and should be treated as illustrative rather than predictive.

For example, Coinbase is a Nasdaq-listed company and is sometimes used as a reference point in such discussions. However, Digitap is an early-stage project and not comparable in scale, operating history, or disclosure requirements. Any attempt to translate per-user valuation benchmarks into a token price depends on uncertain inputs and does not establish a reliable price target.

Solana’s Metrics Are Strong, But Upside Looks More Measured

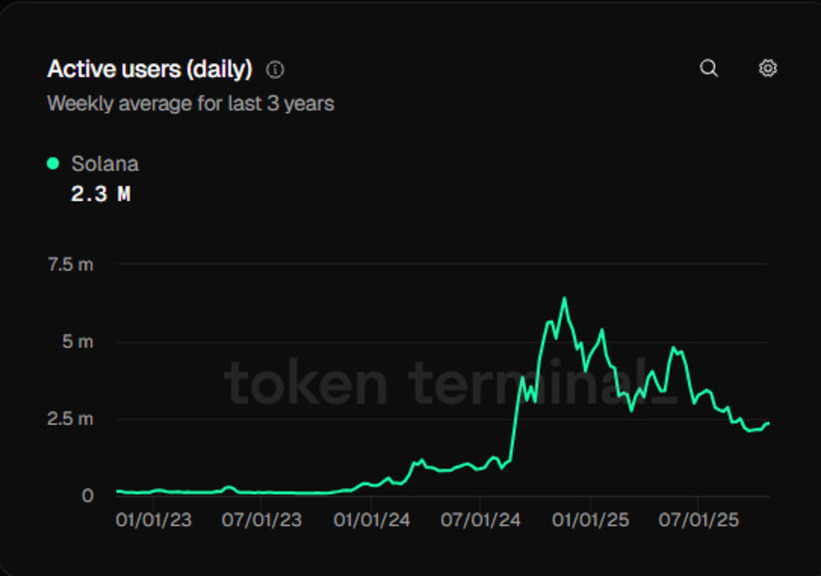

Solana has seen substantial long-term price appreciation, alongside growth in on-chain activity in recent years. For example, total value locked has risen from less than $300 million in mid-2023 to around $11.5 billion today, according to DefiLlama. Active daily users have also grown from around 100,000 in mid-2023 to around 2.5 million today, according to Token Terminal.

Even with strong network metrics, projecting future returns is uncertain. As an asset grows in market value, additional upside may require larger inflows of capital and sustained adoption, but outcomes can vary widely depending on market conditions and broader crypto risk sentiment.

Some market observers point to potential catalysts such as proposed ETFs and activity by publicly traded companies associated with Solana-related strategies, though the timing and impact of such developments are not guaranteed. Price levels discussed in markets, including prior highs, should not be treated as expectations of where SOL will trade in the future.

Two Paths: Early-Stage Digitap Risk Vs. Mature Solana

Digitap and Solana represent different profiles in the crypto market. Digitap is an early-stage project running a token sale and presenting product claims about payments and banking-style features, while Solana is a large, widely traded network with more established market history. Any comparison involves different risk factors, including liquidity, disclosure, regulatory considerations, and execution risk.

Digitap’s longer-term outcomes depend on product adoption, regulatory compliance, and the project’s ability to compete in payments and financial services—areas that are typically heavily regulated. Speculative token price targets based on market-sizing or user-based valuation assumptions may not materialize.

Project links (for reference):

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned. Crypto assets are volatile and carry risk; readers should do their own research and consider their circumstances before making any financial decisions.