TL;DR

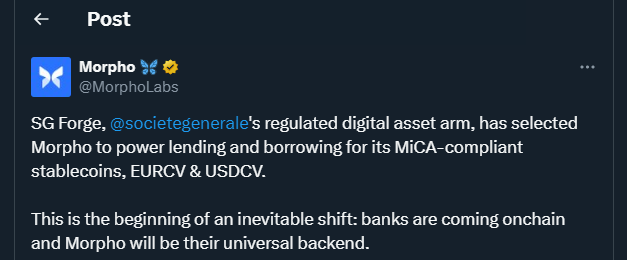

- Societe Generale’s digital division SG-FORGE launched its euro and dollar stablecoins, EURCV and USDCV, on Ethereum-based DeFi protocols, enabling lending, borrowing, and spot trading.

- Morpho supports loans with crypto and tokenized fund collateral, while Uniswap offers permissionless swaps with liquidity managed by Flowdesk.

- The initiative connects regulated finance with on-chain infrastructure, offering continuous execution, enhanced transparency, and new opportunities for institutional participants.

Societe Generale’s SG-FORGE now allows users to access its regulated stablecoins EURCV and USDCV on Morpho and Uniswap, enabling decentralized borrowing, lending, and spot trading. The euro and dollar tokens are backed by smart contracts that ensure continuous operation, creating a regulated bridge between traditional finance and DeFi ecosystems. Through this deployment, the bank is offering 24/7 availability for transactions, with operations supported by tokenized money market funds and cryptocurrencies such as BTC and ETH.

Morpho Lending Brings Regulated Collateral And Automated Risk Management

On Morpho, EURCV and USDCV can be lent or borrowed against digital assets and tokenized funds like USTBL and EUTBL, which invest in US and Eurozone Treasury bills. MEV Capital manages these vaults, establishing eligibility criteria for collateral and handling potential defaults. The system allows for granular control of positions, automatic liquidations, and integration with other DeFi protocols, reducing operational friction while maintaining a compliance-focused environment suitable for institutional participants.

Uniswap Spot Markets Enable Permissionless Trading

The Uniswap listings create new spot markets for EURCV and USDCV, with Flowdesk providing liquidity to minimize slippage. This allows traders to swap these regulated stablecoins directly on-chain without relying on traditional intermediaries. Automated execution ensures consistent performance even during periods of high market activity, providing deeper liquidity and more stable prices for users. While the market capitalization of EURCV and USDCV remains smaller than leading stablecoins like USDT or EURC, their DeFi integration enhances accessibility and composability within the Ethereum ecosystem.

On-Chain Governance And Operational Oversight

Lending and borrowing operations are executed via smart contracts with defined parameters for LTV, collateral type, and liquidation rules. MEV Capital oversees vaults and can intervene when positions are at risk, with plans to gradually expand acceptable collateral. By combining regulated oversight with decentralized execution, SG-FORGE creates a secure and transparent environment for DeFi participants while maintaining compliance with French financial authorities.

Looking Ahead

The initiative marks a meaningful step for regulated banks in DeFi, demonstrating how traditional finance can integrate with on-chain protocols. While EURCV and USDCV are smaller in scale, their presence in lending and trading pools may attract institutional managers seeking stable, regulated assets within Ethereum-based ecosystems.