TL;DR

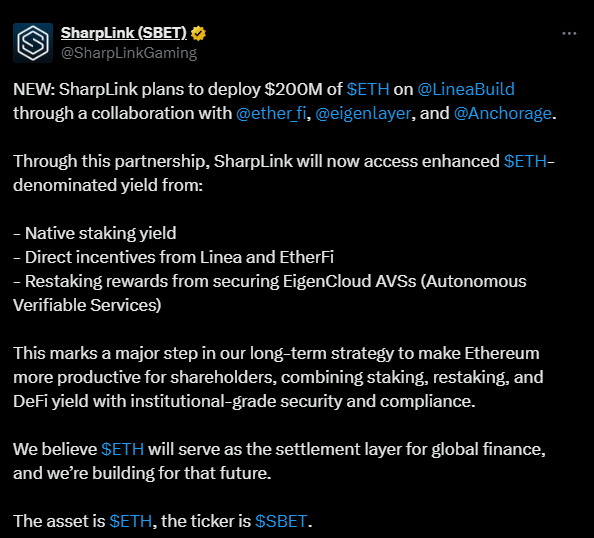

- SharpLink Gaming will deploy $200 million in ETH from its corporate treasury on Linea, ConsenSys’ Ethereum L2 network, to generate yields.

- The strategy combines staking, restaking, and AI-powered yield programs.

- This is the first phase of a multi-year plan to develop institutional DeFi tools and tokenized equity models.

SharpLink Gaming, Inc., one of the largest corporate holders of Ethereum, announced it will deploy $200 million in ETH from its corporate treasury onto Linea, the Ethereum L2 network developed by ConsenSys.

The operation will take place through an institutional collaboration with Anchorage Digital Bank, ether.fi, and EigenCloud, combining staking, restaking, and AI-powered yield strategies to generate ETH-denominated returns.

Initiatives on the Horizon

SharpLink’s Co-CEO, Joseph Chalom, stated that the initiative aims to optimize corporate treasury management with an institutional approach, accessing Ethereum’s top yields through DeFi while maintaining the security and regulatory compliance expected by shareholders. Chalom emphasized that the strategy demonstrates the company’s commitment to responsibly enhance returns and unlock scalable treasury performance.

Linea, ConsenSys’ zkEVM solution, is specifically designed for enterprises and institutions requiring high-performance Ethereum infrastructure. Joseph Lubin, ConsenSys Founder and Ethereum co-founder, explained that Linea will allow SharpLink to earn enhanced native yields through partners such as ether.fi and EigenCloud, creating a replicable model for other institutions.

The deployment will integrate EigenCloud’s Autonomous Verifiable Services (AVSs), enabling the ETH not only to generate staking yields but also to support decentralized AI models and verifiable computational workloads. According to Sreeram Kannan, CEO of Eigen Labs, this collaboration lays the foundation for a verifiable economy where AI, DeFi, and infrastructure converge, creating new opportunities for institutional asset management.

SharpLink and ConsenSys to Develop Liquidity Tools and DeFi Products

Anchorage Digital, as a qualified custodian, will facilitate the strategy’s execution, which combines Ethereum staking rewards, EigenCloud restaking incentives, and Linea’s native yield programs. Nathan McCauley, CEO of Anchorage, described the operation as the beginning of Ethereum’s “institutional era,” where innovation and regulatory compliance advance in tandem.

This $200 million deployment is expected to be only the first phase of a multi-year commitment, during which SharpLink and ConsenSys plan to develop programmable liquidity tools, tokenized equity models, and institutional-grade DeFi products