TL;DR

- Santiment detected a surge in crypto-related chats in January, with Bitcoin, Beam, Ethereum, Chainlink, USDT, and MicroStrategy leading the growth.

- Bitcoin was at the center of discussions following Strategy’s purchase of more than 22,000 BTC for $2.13 billion.

- Ethereum drew attention due to more than 30% of its supply being staked, Chainlink for its role as financial infrastructure, and USDT for its operational use.

Santiment recorded a sharp increase in the volume of crypto chats across social media in January. The data shows that Bitcoin, Beam, Ethereum, Chainlink, USDT, and MicroStrategy captured the strongest growth in mentions, driven by institutional activity, staking metrics, technical developments, and the operational use of on-chain infrastructure.

Crypto Chat: Usage, Staking, Supply, and Centralization

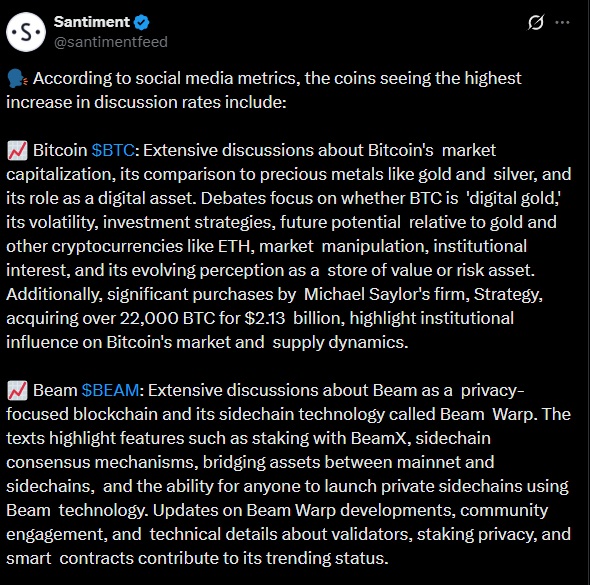

Bitcoin topped the chat and discussion rankings. Posts focused on its market capitalization, comparisons with gold and silver, and its role within financial portfolios. The rise in mentions coincided with an institutional purchase: Strategy acquired more than 22,000 BTC for approximately $2.13 billion. That transaction renewed attention on available supply and the impact of large-scale buyers. Strategy appeared repeatedly as a stock market proxy for Bitcoin, with close tracking of its share price and the continuation of its accumulation strategy. Traditional funds, including Vanguard, increased their exposure to MSTR shares.

Beam posted a steady increase in mentions linked to its privacy-focused infrastructure. Discussions revolved around Beam Warp, its sidechain system, staking through BeamX, validator setup, and asset transfer mechanisms between the main network and private sidechains. Interest was supported by technical updates and direct community participation in operational processes.

Ethereum Under Scrutiny Due to High Staked Supply

Ethereum saw a clear rise in attention tied to staking. More than 30% of the total ETH supply remains locked. Posts highlighted large staking operations by specialized firms, elevated transaction levels on the network, and flows related to products such as ETFs. The focus stayed on network metrics, yields, and institutional activity.

Chainlink regained visibility due to its role as an infrastructure layer. Mentions included its expansion to provide on-chain data linked to the U.S. stock market, estimated at $80 trillion, its integration with DeFi protocols, LINK staking, and adoption by financial institutions. References also appeared to its ties with the NYSE and the launch of LINK futures on the CME.

USDT maintained a constant presence in social media chats . The use of the stablecoin as a savings and remittance tool in high-inflation economies such as Venezuela appeared repeatedly. Mentions also covered trading pairs, futures, listings, and promotional campaigns, alongside discussions around centralization, peg stability, liquidity, and regulation.