TL;DR

- ASTER was listed on Robinhood, strengthening its presence in the U.S. market and reaching a valuation of $2.53 billion.

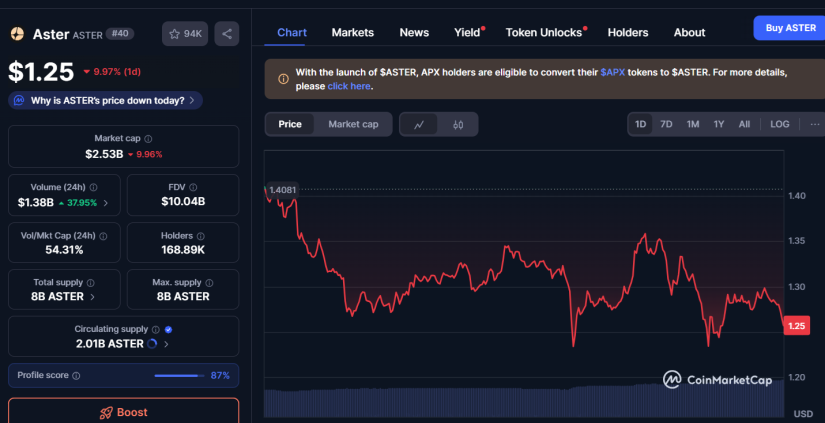

- The token dropped 10% in the past 24 hours to $1.25, a result of profit-taking after weeks of volatility.

- Despite a weak market, the listing on a regulated exchange enhances the token’s legitimacy and visibility, laying the groundwork for a potential rebound in the future.

ASTER token began trading on Robinhood, a crucial step in its expansion into the U.S. retail market.

Integration into one of the most widely used platforms by retail traders will boost the project’s presence in the ecosystem, reaching millions of new investors. However, the initial enthusiasm did not translate into market price: according to CoinMarketCap data, ASTER fell 10% in the last 24 hours and is trading around $1.25 per token, giving it a market capitalization of approximately $2.53 billion.

Weak Market Suppresses Short-Term Gains

Its performance partly reflects early profit-taking. Analysts note that after weeks of pre-listing volatility, many holders took advantage of the Robinhood debut to secure their gains.

This pattern is common for tokens newly listed on major exchanges, where media hype often precedes sustained demand. For ASTER, technical indicators also confirm a natural pause in momentum. The RSI near 42 suggests the token is neither oversold nor signaling a rebound, while the MACD remains in a neutral zone, indicating a consolidation period before any significant next move.

Broader market conditions have played a key role. Market weakness, combined with low liquidity and risk reduction measures, is limiting the recovery potential even for assets with positive catalysts. Still, Robinhood’s history shows that newly listed tokens often experience delayed rallies as retail participation grows and liquidity accumulates on the platform.

ASTER Repositions Structurally

Beyond short-term price behavior, the listing strengthens ASTER’s structural positioning. Inclusion on a regulated U.S. exchange not only increases its visibility but also legitimizes its presence for new investors and institutions. For the project, it represents another step toward becoming one of the most widely adopted networks in the blockchain industry.

As market stability returns and retail volume picks up, Robinhood could become a catalyst for a new phase of growth. For now, ASTER enters a technical maturity phase, with a broader user base and significantly greater exposure through one of the largest entry points in the crypto ecosystem.