Ripple Inc. Liquidates More XRP

There are, and there will be centralization concerns as long as Ripple Inc. has majority control of XRP coins. With a 55 percent stake on total XRP supply, and a decentralization strategy in place, Ripple Inc.-being an independent company separate from the Ripple Labs, the official issuer of XRP, Brad Garlinghouse-led San Francisco startup often sell their XRP stash to institutions, HNWI and exchanges to finance their operations through their noticeable OTC operations. All sales are captured in their quarterly reports.

Through Xpring, Ripple Inc. has continued to fund, acquire and even invest in several projects with the latest being Logos Network. Reports indicate that Ripple recently sold 31 million XRP coins translating to roughly $7.4 million at market rates to institutions, exchanges and several high net investors translating to roughly 99 million or $24.1 million in cumulative total before the end of the quarter.

Xpring Operations and Logos Network

While these wholesale movement are a source of concern to investors and traders who insist that XRP is dumping on them, Ripple needs cash inflow for operation and expansion as they bid to build a platform where users from across the world can easily send and receive funds cheaply.

The acquisition of Logos Network could be part of their overall objective.

As part of Xpring, the Logos team will be leading an ongoing initiative to explore a decentralized financial (DeFi) system that will leverage XRP at its core, as well as other ideas we are exploring to leverage crypto to transform payments and finance. The Logos team will bring even more horsepower to what the Xpring team can deliver.

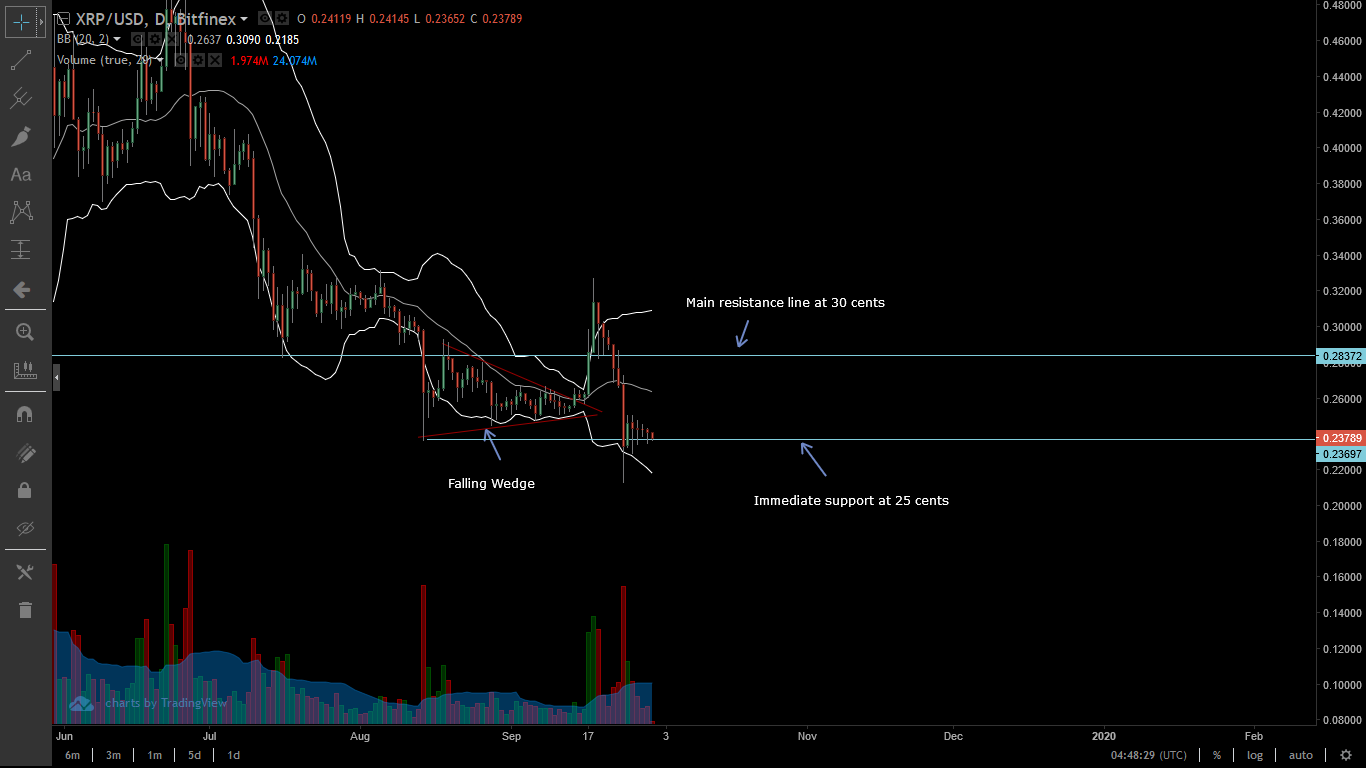

XRP/USD Price Analysis

While XRP prices have been stable in the last day against the USD, it has registered impressive gains against BTC and ETH over the last week. Gaining 11% against BTC, and 8% versus ETH, buyers XRP could inch higher going forward.

However, since losses against the greenback are pronounced, there must be sharp gains in the immediate terms for buyers to be in control. With support at 25 cents, the best course of action is to wait for complete reversal of Sep 24 losses, or for a close below the 23-25 cents main support line in a bear continuation phase confirming losses of Sep 24 and those of Q2 2019.

Because of this, traders should be neutral, and unload their holdings for USD if prices dip below this 25 cents. Conversely, any up thrust lifting XRP above 30 cents, completely reversing losses of Sep 24 at the back of high trading volumes exceeding $100 million could see XRP soar to 40 cents by the end of Q4 2019.

Chart courtesy of Coinalyze

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.