Latest Ripple [XRP] News

Even with a market cap of $19,089 million and striding 10.8 percent week-to-date, XRP performance is not as expected. It is not racing as buyers press the accelerator pedal. That’s despite trading above important resistance levels at the back of above average volumes.

Even so, that’s not to say the fundamentals behind the third most liquid asset are not bullish. Note that the objective of Ripple Inc is to create a fluid system. A blockchain based network that can compete, outshine, outperform and clip SWIFT market share. That alone may take years but before then, developments of the past two years or so is extremely bullish.

At the end of the day, the goal is for XRP to decouple with BTC, that’s perhaps why prices have been in recent months diverging. As BTC record new highs that to upbeat investors, XRP bulls appear jaded. The result was a 6-months consolidation within a 10 cents trade range.

But as it is, the entry of banks and relaxation of rules guiding coins and tokens could see XRP flourish. Already the US SEC through the Director of Corporation Finance William Hinman said the agency may issue no-action letters to tokens/coins of blockchain projects deeming their assets utilities even if during crowd funding they may have flouted with some rules. But there is a cap, this is also applicable for projects that demonstrate with use cases.

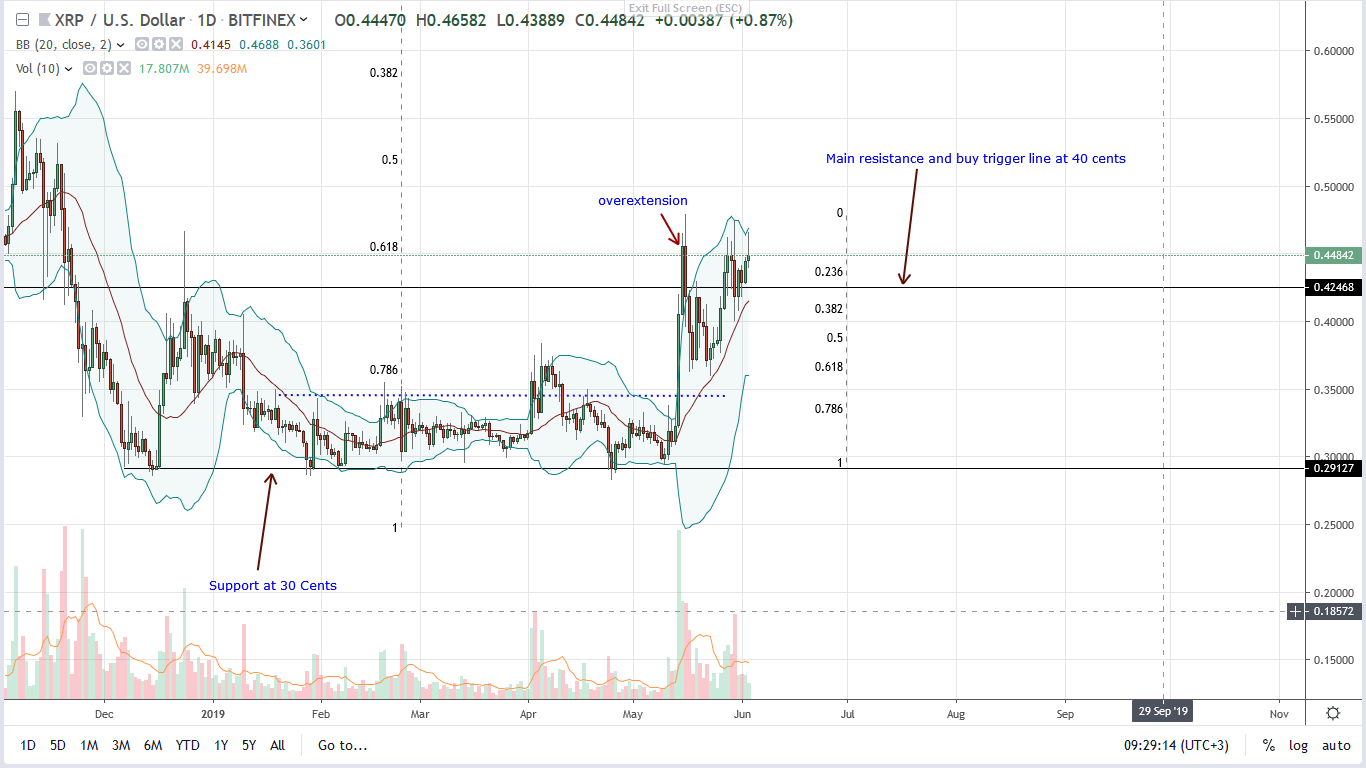

XRP/USD Price Analysis

At the time of writing, and as aforementioned, XRP is up 10.8 percent from last week’s close. Changing hands at 45 cents, the coin is trading above important liquidation zone of 40-43 cents implying that buyers are in control in a bullish breakout pattern.

Even though XRP risk-off or aggressive traders can find loading opportunities on dips as long as prices are above 43 cents, those who failed to capitalize on the breakout can wait for clearance above May 2019 highs at 50 cents before buying on dips with safe stops at 40 cents and targets at 60 cents.

It’s easy to see why. Prices are consolidating and behind this ranging are shrinking volumes within May 14th and 15th trade range. Besides, the fact that prices reacted from the 61.8 percent Fibonacci retracement level at the back of decent volumes is bullish.

To mark buy trend continuation, it will be ideal if the close above 50 cents is at the back of high trading volumes exceeding 187 million of May 14th. After that, odds of prices rallying to 80 cents will be high.

All Charts Courtesy of TradingView—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.