The Ripple price is on its usual gyrations but what’s solid–even from a neutral’s perspective, are the project’s solid fundamentals. There are understandable ups and downs, more so to with the asset’s rightful classification.

A possible dent to Ripple and Brad Garlinghouse’s goals, whether the coin is a utility or not, will only be sealed by hints from first the court—and second, a strong word from the main regulator—the U.S. Securities and Exchange Commission (SEC). Both are yet to mention a word about the third most valuable asset.

Meanwhile, there are some bullish announcement as Ripple continues to offer solutions to partners and possibly XRP through the On-Demand Liquidity (ODL) in the future.

Banco Santander and One Pay FX expansion

On Friday, Banco Santander announced their expansion into new regions. The Spanish bank is one of the largest in the world and has an impressive reputation of embracing technology.

In a statement released by Ripple, it was revealed that One Pay FX, a transformative remittance platform, will be expanded to 19 new countries and regions.

The App’s CTO, Ed Metzger, said the app was launched to resolve issues to do with speed, opacity, and to most importantly improve customer experience.

Since they are guided by the customer and are actively looking to narrow the gap between their client’s desires and what they have availed, their partnership with Ripple has already helped them directly access issues raised by the clients.

“Being part of RippleNet has helped us to forge sustainable and scalable relationships with other financial institutions around the world. By offering more customers a better way of sending money abroad, we’re achieving our goal of helping people and companies prosper.”

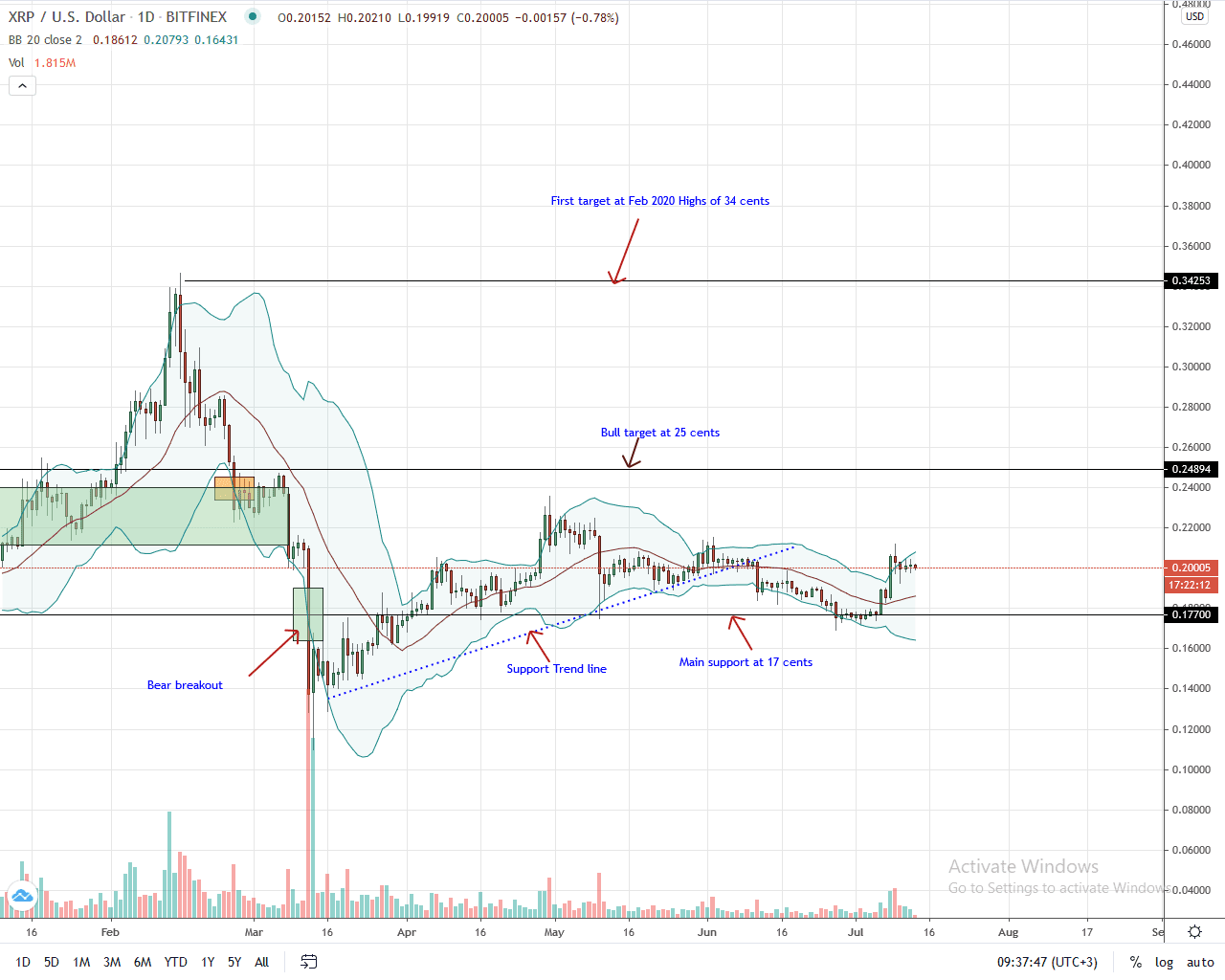

Ripple Price Analysis

At the time of writing, XRP is one of the top performers. Trending at around the $0.20 mark, the coin is up in double digits against the USD—adding 13 percent, and BTC—10 percent. It has also gained versus ETH—adding five percent.

From the daily chart, it is clear that bulls have the upper hand. Despite a blip—and slight over-valuation on July 8, 2020—when the price of XRP closed above the upper BB, the uptrend is clear and bulls may in days ahead.

Notably, the conspicuous bullish candlestick of July 8, 2020 confirmed by double bar bullish reversal pattern of July 6, 2020. Accompanying this shift of demand were high trading volumes and the confirmation of the BB squeeze of the last few weeks where XRP prices have been trending lower. If bulls bar trend along the upper BB and stay above the 20-day moving average, buyers would be in control.

As such, every low should technically be a buying opportunity with targets at $0.25 or $30 in the medium term.

Any dips below $0.17—reversing gains of July 6, 2020, may invalidate this forecast especially if the move is at the back of high trading volumes.

Technical Chart courtesy of Trading View.

Disclaimer: This is not investment advice. Opinions expressed here are those of the author and not the view of the publication.

If you found this article interesting, here you can find more Ripple News