At the Dubai Fintech Summit, the CEO of Ripple, Brad Garlinghouse, revealed that the firm has spent almost $200 million defending itself in the case with the SEC. He highlighted how the US is stuck in comparison to the regulatory progress of the UAE Virtual Asset Regulatory Authority and the most recent MiCA bill in the European Union. In his message to the chair of the SEC, Garlinghouse expressed regret about the US falling behind as the firm expands into the UAE.

According to him, the tough thing about the entire situation is having a country that prioritizes politics in favor of policy. When asked if the US needed a clear framework surrounding crypto clarity, the Ripple CEO highlighted how the SEC must understand that a major chunk of actors in the game want clarity so they could follow the rules by the book in a better way.

Ripple was sued by the SEC back in 2020 after the regulatory body claimed that the firm illegally sold XRP as an unregistered security. However, Ripple has long disputed the claim that it does not constitute an investment contract under the Howey test. The case has been ongoing since then, but it is expected that a decision would be announced in the upcoming few months.

Ripple Expands to the UAE

Ripple has joined the ranks of some of the first crypto firms to have expanded base of operations in other countries, especially after regulatory pressures in the US tend to blaze on. Currently, the firm is set to open its new office in the heart of Dubai International Financial Centre. Furthermore, Ripple has prioritized serving customers throughout the world, with more than 90% of the firm’s business outside American soil.

On Ripple’s expansion plans, Garlinghouse stated,

“We chose Dubai as both a key office for Ripple, and to bring Swell Global to the city, in large part due to its forward-thinking regulatory environment. Regulators here have risen to the challenge of establishing a framework that allows the local crypto industry to thrive, create jobs and increase economic growth, while also ensuring participants act in a responsible manner”

In 2021, Ripple announced the launch of its first On-Demand Liquidity in the Middle East in a joint venture with Pyypl, a blockchain-based financial services technology company. ODL is responsible for leveraging XRP to underpin instantaneous and low-cost cross-border payments. Through the use of ODL, it became possible for organizations of all sizes to leverage pre-funded capital to grow and scale their businesses.

Whales EYE Ripple (XRP) as the Market Declines

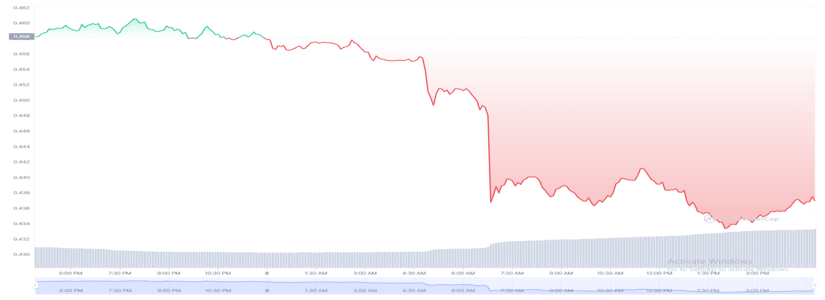

Keeping in mind the current macroeconomic factors, the crypto market has been on the decline. The sell-off in the market during the first week of May did not help Ripple (XRP). Currently, it seems that the token is approaching oversold levels, as portrayed by the daily RSI.

At the time of writing, Ripple (XRP) is trading for approximately $0.4367 after suffering a decline of almost 4.89% in the previous 24 hours. Keeping the recent dip in mind, the masses believe that whales are starting to make their moves. The crypto data tracker, Whale Move, spotted major Ripple (XRP) moves in the last 24 hours.

The most recent was a 50 million XRP transfer from Crypto.com to an unknown whale wallet. At the same time, an additional 113.2 million XRP were swapped between unknown wallets. Apart from these two, more than 29 million XRP tokens moved from an unknown wallet to the Bitstamp exchange.