The Ripple price remains firm, unshaken, unmoved lodged at seventh.

Although there might be unfavorable conditions, such as the unsupportive movement of BTC prices—at least in the first half of the last week-there are hints of growth–a refresher for optimistic XRP fans.

Specifically, the ongoing court case is a fundamental trigger. If anything, Ripple as a financial company and crypto as a scene will immensely benefit from this development. A win against the agency could, quite literally, is freedom considering how, if history guides, the SEC has been clamping down on crypto projects.

The SEC-Ripple Battle, Success Means Expansion

In the past years, several projects—especially ICO-funded ones—have been pulled down by the SEC for allegedly floating several binding rules applicable to U.S. citizens. Therefore, looking ahead, XRP as a utility token and Ripple as a project would be unbridled, attracting an unparalleled level of liquidity and capital investment.

More importantly, it will also allow Ripple to expand—aggressively, as Asheesh Birla, in early 2020, said was their objective this year. Already, Ripple, despite existing regulatory obstacles, is attractive to clients.

Clients prefer to leverage the XRPL and the On-Demand Liquidity (ODL) as preferable liquidity for moving funds across borders cheaply and instantly.

Regulation in Germany

Coupled with the approval of the Fund Location Act in Germany, funds can now allocate as much as 20 percent into any potent cryptocurrency project.

The approval and potential fund exposure to the high-value blockchain-based projects endorse crypto as an emerging asset class.

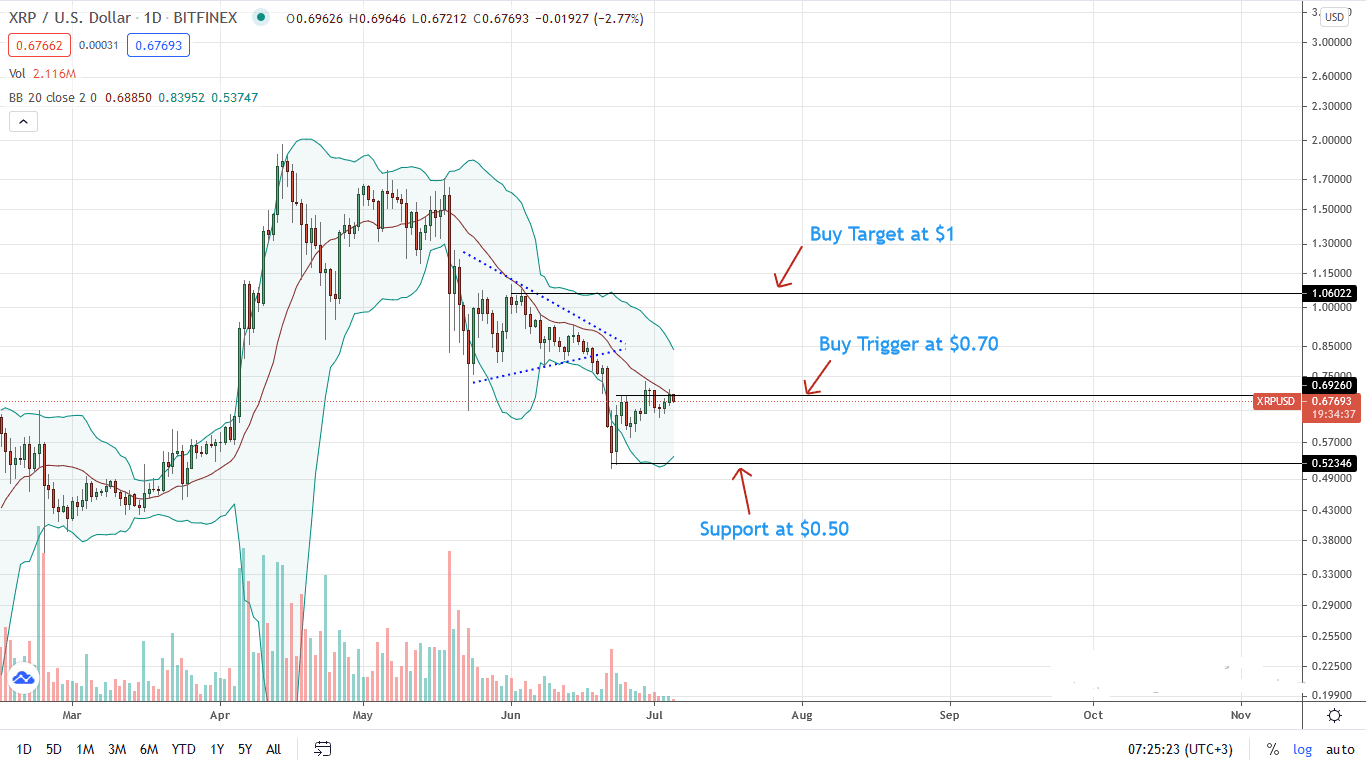

Ripple Price Analysis

Technically, XRP/USD prices are trending lower, within a bear breakout pattern following losses on June 21. Although XRP prices are within the bar’s trade range, the path of least resistance, at least for now, is feebly northwards.

Impressively, XRP bulls could, as per development from the development in the daily chart, close above the middle BB and $0.75—Jun 21 highs.

If not, bears are in control from an Effort-versus-Results perspective.

Ideally, a high-volume conclusive close above the $0.75-$0.80 zone may be enough to build momentum for the next phase of higher highs towards $1.

This is so because the $0.75 and $0.80 region represents a strong resistance level—visible clearly in the weekly chart—September 20218 highs—an important reaction point that shapes XRP/USD price action.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ripple news

![Ripple [XRP]](https://crypto-economy.com//wp-content/uploads/2020/07/ripple-pr-1024x576.jpg)