TL;DR

- Ripple faces renewed scrutiny after investor Andrei Jikh questioned why its claimed 300+ bank partnerships do not translate into massive daily onchain volume.

- Ripple’s CTO David Schwartz responded that institutions still prefer offchain settlement for security and compliance reasons but hinted at future onchain migration.

- Despite recent tokenization deals and expansion efforts, XRPL’s reported activity dropped over 30% in Q1 2025, fueling calls for greater transparency.

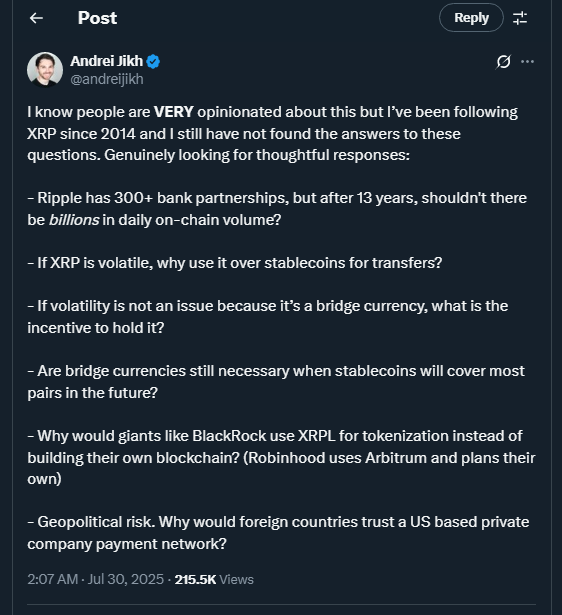

Ripple, the driving force behind the XRP cryptocurrency, is once again under the spotlight as market participants ask tough questions about whether its institutional claims align with blockchain evidence. Online entrepreneur Andrei Jikh sparked the discussion with a viral tweet listing six pointed questions about Ripple’s operations. He asked why, after more than a decade and hundreds of bank partnerships, billions in daily onchain volume have yet to materialize.

In his post, Jikh wrote:

“I know people are VERY opinionated about this but I’ve been following XRP since 2014 and I still have not found the answers to these questions.”

His concerns touch on the practicality of XRP as a bridge asset, its volatility compared to stablecoins, and whether financial giants like BlackRock would realistically adopt the XRPL rather than build their own blockchains.

Ripple’s CTO Schwartz Responds With Transparency Push

David Schwartz, Ripple’s chief technology officer, stepped in on X (formerly Twitter) to address each point. Reposting Jikh’s questions, Schwartz (@JoelKatz) explained that institutions have historically preferred offchain usage to avoid risks like terrorism financing and regulatory friction. He said this tendency is “close to changing” as banks recognize onchain advantages but admitted adoption has been slower than expected.

Schwartz argued that XRP’s volatility can actually benefit some use cases, providing a liquid bridge when multiple stablecoins co-exist. He pointed out that no single stablecoin can dominate globally due to jurisdictional barriers.

Tokenization Efforts And Offchain Settlements Fuel Debate

Ripple’s ambition to expand XRPL’s enterprise use is evident in recent partnerships. In June 2025, the company announced tokenization pilots with Dubai’s government and investment heavyweight Guggenheim. However, onchain numbers remain modest. Data from DefiLlama shows only about $81.8 million locked in XRPL DeFi apps, with most institutional flows reportedly happening offchain.

Ripple’s latest quarterly report confirmed a 30%–40% drop in XRPL activity during Q1 2025, even as the broader crypto market faced similar contractions. The company has since decided to discontinue its traditional XRP Markets Report, promising to share updates through its main channels instead. Schwartz maintained that XRP’s role as a bridge asset still makes sense in a fragmented stablecoin world.