TL;DR

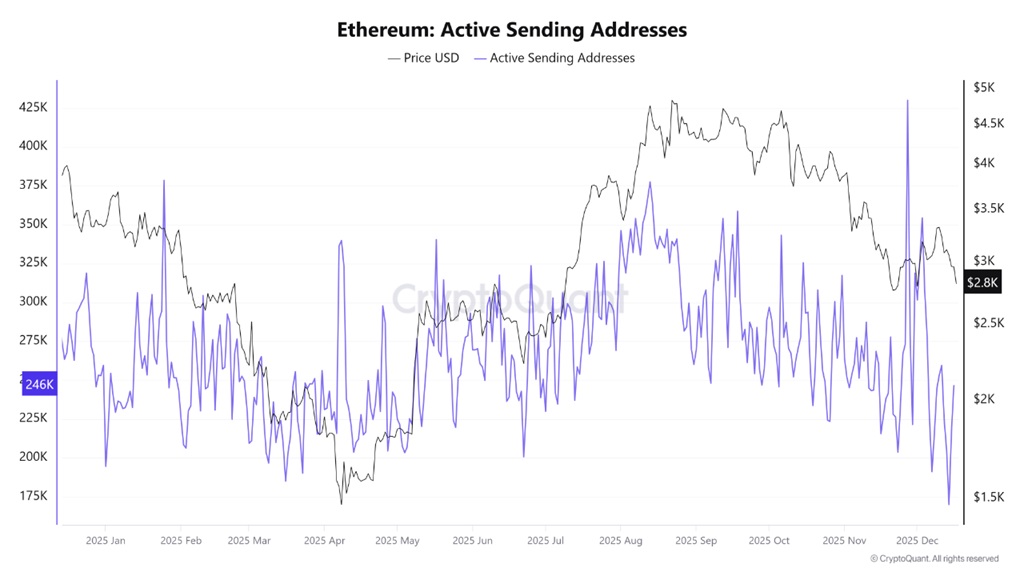

- Ethereum is operating with low activity: the network has hit a 12-month low, with active addresses hovering around 170,000, a clear sign of retail users pulling back.

- ETH fell below $2,850 in line with declining network activity, a setup that often reflects seller exhaustion but lacks fresh demand to support a rebound.

- With neither retail nor institutional flows, any recovery depends on a rise in active addresses; without that on-chain signal, the market remains stuck in consolidation.

Ethereum is going through a phase of weak operational momentum that says more about participant behavior than about price action itself.

Network activity has dropped to a 12-month low, with active addresses approaching the 170,000 mark. Historically, that level consistently signals a clear retreat by retail users or a collective decision to stay sidelined.

Retail Steps Back or Chooses Not to Trade: The Market Waits

Price action is moving in line with the deterioration in network activity. ETH slipped below $2,850 amid a broader market correction, but the meaningful signal is not on the chart, it is on the network. Retail absence usually shows up after prolonged periods of volatility and downside adjustments. The result is lower daily participation and a market dominated by waiting.

From an on-chain perspective, this environment often aligns with phases of seller exhaustion. Selling pressure fades because those who wanted to exit have already done so. However, fresh demand has yet to appear. That gap explains why price stabilizes without delivering a meaningful recovery. There are not enough flows to sustain a rebound.

The lack of retail participation also caps immediate upside potential. In previous cycles, retail demand fueled the early stages of recoveries. Without that component, any bounce remains vulnerable to quick selling and narrow ranges. Even so, this same low-activity backdrop has repeatedly preceded periods of quiet accumulation by long-term holders, who tend to act once the noise fades.

CryptoQuant is explicit on this point. Price alone does not confirm a recovery. The structural signal comes when price stabilizes while active addresses begin to rise steadily. That combination points to real demand and stronger network usage. If activity stays flat or continues to decline, the risk of deeper consolidation or a demand-destruction phase increases.

Institutional Activity Fails to Spark a Recovery

Institutional flows are not providing immediate relief either. Spot Ethereum ETFs recorded heavy outflows, close to $225 million in a single day, followed by additional withdrawals in subsequent sessions. Volatility in U.S. equities and the lack of clear signals from monetary policy continue to weigh on risk appetite.

The setup is uncomfortable, but not unusual. Ethereum is operating in a short-term weak environment, shaped by retail absence and institutional caution. Historically, these conditions have appeared near structural bottoms. Activity will make the difference. Without it, there is no sustainable recovery