TL;DR

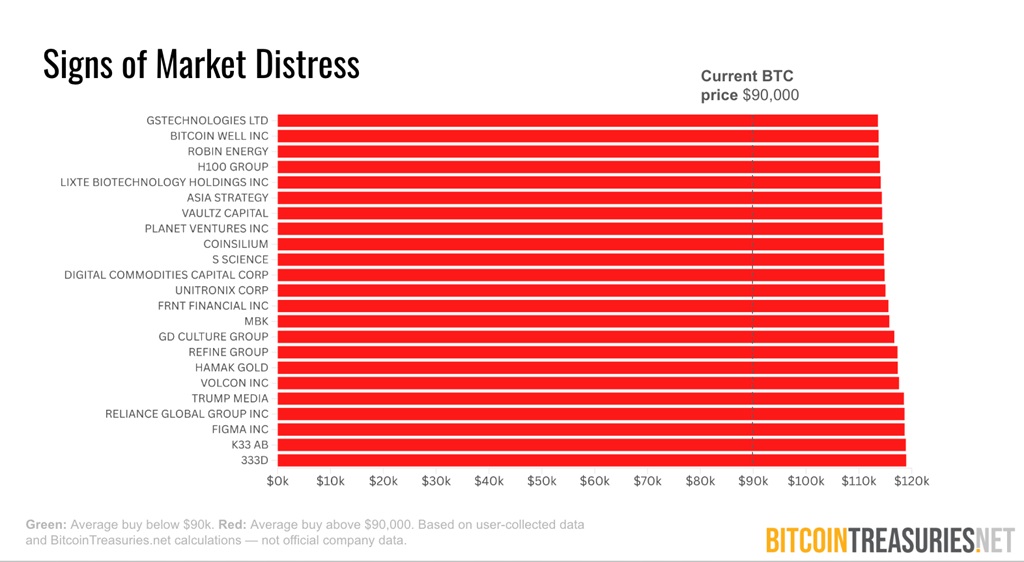

- A report from Bitcoin Treasuries shows that most Bitcoin-buying companies are holding unrealized losses.

- 65% of the companies analyzed purchased BTC above $90,000.

- Five companies, including Hut 8 and Sequans, executed targeted sales to reduce risk.

A recent report from Bitcoin Treasuries reveals that the majority of companies buying Bitcoin are sitting on unrealized losses, while a small group sold part of their holdings following the price drop in November.

The 122-page document analyzes 100 companies and highlights that 65% purchased BTC above $90,000, leaving most treasuries in the red, including those that sought to capitalize on the early-year rally.

The BTC price drop, which reached $81,000, created significant mark-to-market pressure. The report emphasizes that this does not indicate a widespread crisis but forces risk committees and boards to better assess the risks of buying at elevated prices and relying on future gains to validate treasury decisions.

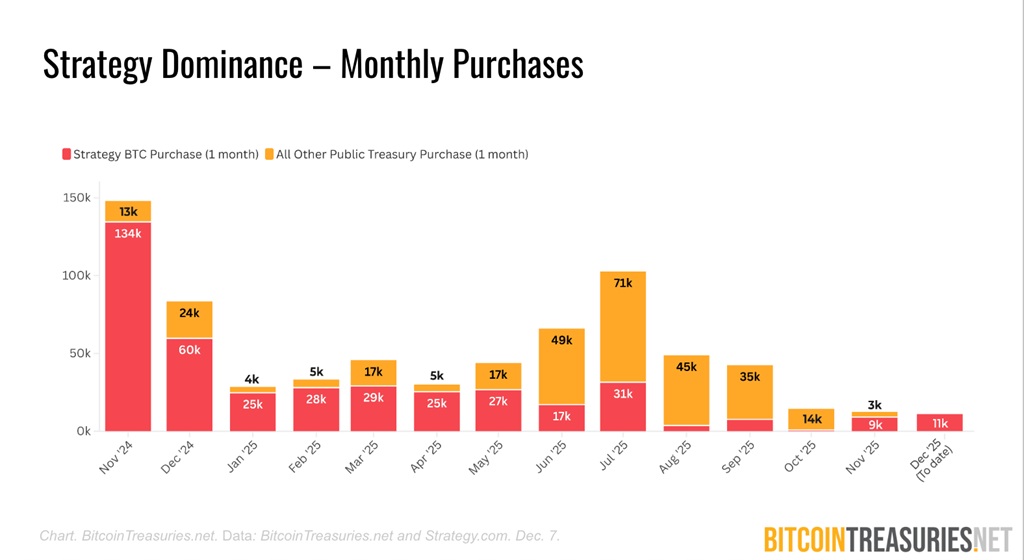

Strategy Continues Buying Despite Volatility

Despite market volatility, the largest treasuries continued purchasing. Companies like Strategy and Strive accounted for most net additions in November, with Strategy responsible for roughly 72–75% of the month’s purchases, totaling about 9,000 BTC. Meanwhile, five companies, including Hut 8 and Sequans, sold part of their assets, with Sequans standing out for offloading about a third of its holdings. Overall, companies netted 10,750 Bitcoin during the month.

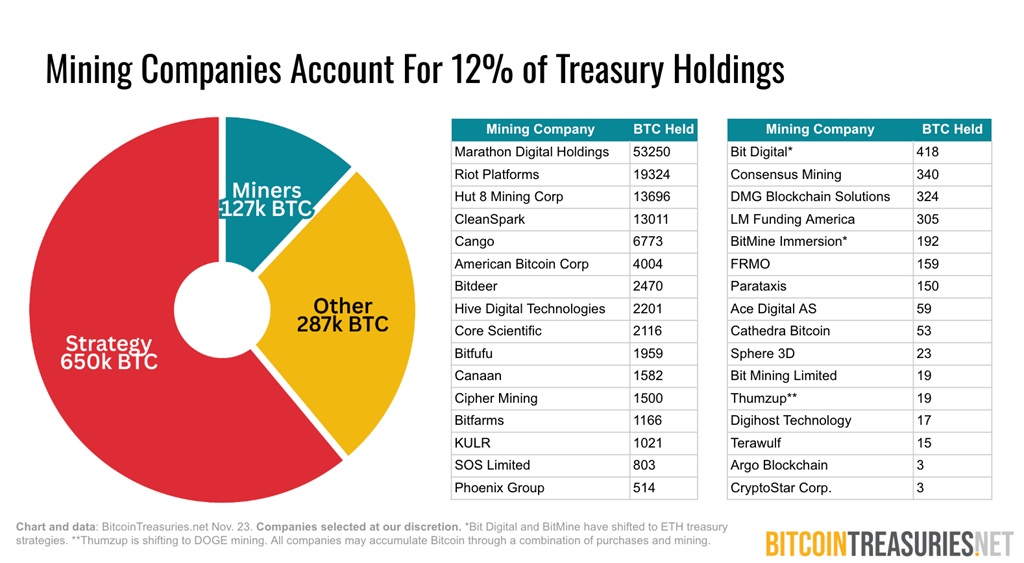

Miners remain structurally important in corporate adoption. They accounted for around 5% of new purchases and 12% of the total public company Bitcoin balance. Since miners can acquire BTC at an effective cost below the spot price, their holdings help sustain corporate activity even when other buyers slow their pace.

Only 28 Companies Purchased Bitcoin in November

The report also shows that active participation declined: only 28 companies disclosed purchases in November, although approximately 60 first-time buyers, who had not previously reported acquisitions, were included. This indicates an adjustment toward a more selective buying pace following the purchase boom of earlier months.

Disciplined strategies can still generate moderate gains or withstand stock depreciation, but companies must confront the risks of operating with Bitcoin in a volatile market. November’s price drop serves as a stress test for corporate Bitcoin capital and underscores that risk management and liquidity assessment will be key to maintaining sustainable digital asset treasuries